@DerAufklaerer, you have made an interesting and useful investigation. Thanks for posting the results.

It is obvious that times are changing and conditions are tougher and tougher – cf. information posted by @AlexanderSu here Is Dukascopy Bank SA a trustworthy bank?.

(Yes, it is true that the situation when someone having a Swiss current account is OK with such a low limit as 10000 CHF is – from general point of view – probably not frequent; but anyway.)

The only working solution if you want to hide your funds is to use a crypto (and gold etc.) or to bank in some non-AEOI/CRS country.

It is obvious that times are changing and conditions are tougher and tougher – cf. information posted by @AlexanderSu here Is Dukascopy Bank SA a trustworthy bank?.

(Yes, it is true that the situation when someone having a Swiss current account is OK with such a low limit as 10000 CHF is – from general point of view – probably not frequent; but anyway.)

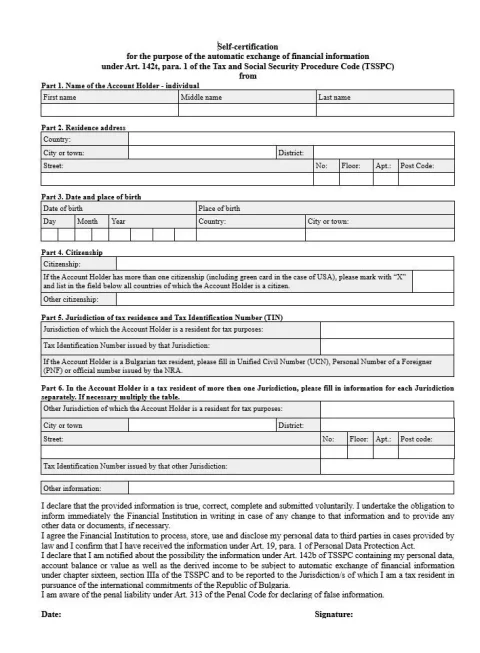

Be aware that any EMI in AEOI/CRS country (both LT and BG are AEOI/CRS) will report you sooner or later. It is completely clear, see the Swiss results. (BTW, did't you posted that iCard had wanted your TIN?)EMI:

- WIREX with SEPA and transfers from/to Crypto Exchanger : BACKUP ICARD (both with VISA/Mastercard Cards)

Both have no Tax/TAN of me

- Wise for non crypto (with Cards)

The only working solution if you want to hide your funds is to use a crypto (and gold etc.) or to bank in some non-AEOI/CRS country.

BTW, be advised that Advcash has an inconsistent reputation, strange issues happened in the past from time to time (search here at forums), similarly for iCard. But it's just a remark.Last but not least Advcash as Last Solution for parking but for me its only a FIAT parking solution (SEPA Transfers withdraw 5 EUR + %)