This is excellent news, *BUT*...how about paperwork, tax, financials, etc., filing?Just giving you a "behind the scenes" update on todays high level FTA Meeting with leading Tax & Legal Firms:

View attachment 4918

We are Happy to confirm one more time that 99% of DLS Dubai Clients remain 0% Corporate Tax and 100% of DLS Dubai Clients are based in Designated Zone.

Congratulations!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UAE clarification of Freezone Qualifying Income

- Thread starter joffreylol

- Start date

Just giving you a "behind the scenes" update on todays high level FTA Meeting with leading Tax & Legal Firms:

View attachment 4918

We are Happy to confirm one more time that 99% of DLS Dubai Clients remain 0% Corporate Tax and 100% of DLS Dubai Clients are based in Designated Zone.

Congratulations!

So 99% of your clients sell physical goods? Why we not talking about digital goods which should represent more than 50% of all the freezones?

Well even that wasn't so clear but it shows the trend and what most people familiar with the UAE since several decades already suspected - most people remain 0% Corporate Tax and the Definition of "Being Creative" is most likely taken to another level.This makes sense regarding B2B transactions, ie buying a pallet of goods from China and reselling them to an Indian business. One issue is that many are selling via Shopify/Amazon/Own website, and these are mostly to individuals, which are specifically excluded (as the law stands today). If they sell to an "Indian business" first, then that Indian business will be liable for corporate tax in India (which could then fall under UAE CFC/PE etc rules).

We introduce 01.07.2023 an in-house Accounting Department with Accounting Manager and Accounting Assistant as a Corporate Tax Filling has to be done no matter what - this is the main point of the OECD by the way - having some paperwork in place as of now the UAE itself doesn't know the books of 100s of thousands company while this may work if you are a Marshall Islands but it doesn't work in the long run for a Growing Economy being on the News like the UAE.This is excellent news, *BUT*...how about paperwork, tax, financials, etc., filing?

Because it takes time for further clarifications - the FTA for sure is overhelmed now and it takes some weeks - I mean it took 3 weeks to get a word of mouth confirmation to some of the Big 4 Partners.So 99% of your clients sell physical goods? Why we not talking about digital goods which should represent more than 50% of all the freezones?

No Freezone published anything either yet - they are all waiting for further FTA Clarifications.

Well, I'm literally waiting for my entry visa and already registered a company. I guess I should have done a bit more research. I had a Dubai agent too not tell me anything about this. He said if your business is outside UAE no tax. I like others, offer it consulting to US clients via a US LLC. Not sure what to expect now.

No definitive answers anywhere. Wait and see I guess.

No definitive answers anywhere. Wait and see I guess.

It seems that Fred might actually be right - there will be like a billion exceptions for CIT both for FZCO and mainland companies. Just enough to let 99% of businesses to pay nothing/close to nothing and yet to maintain the image of UAE as a low-tax jurisdiction and not the tax-free wild west. And the authorities will get a nice income from all the filings and some tax from mainland companies.

That's similar to Singapore and Hong Kong.It seems that Fred might actually be right - there will be like a billion exceptions for CIT both for FZCO and mainland companies. Just enough to let 99% of businesses to pay nothing/close to nothing and yet to maintain the image of UAE as a low-tax jurisdiction and not the tax-free wild west. And the authorities will get a nice income from all the filings and some tax from mainland companies.

It's just a bit strange that people don't understand it. Whole thing could be a good filter UAE has put on now.

It seems that Fred might actually be right - there will be like a billion exceptions for CIT both for FZCO and mainland companies. Just enough to let 99% of businesses to pay nothing/close to nothing and yet to maintain the image of UAE as a low-tax jurisdiction and not the tax-free wild west. And the authorities will get a nice income from all the filings and some tax from mainland companies.

Such conclusions based on?

General speaking - 40 years of Offshore History of the UAE maybe?Such conclusions based on?

Jebel Ali Freezone is almost as old as the UAE itself - think about it.

The whole Offshore thing is an essential fundament of the UAE and they know this.

I like others, offer it consulting to US clients via a US LLC.

There's a risk of the IRS saying you have US-source income anyway.

If the US LLC is owned by a foreign company (like your UAE company), then there is the risk of 30% branch profit tax on top.

So far I haven't met anyone who was actually affected by this, but I've spoken to US tax experts and they said it's a real risk.

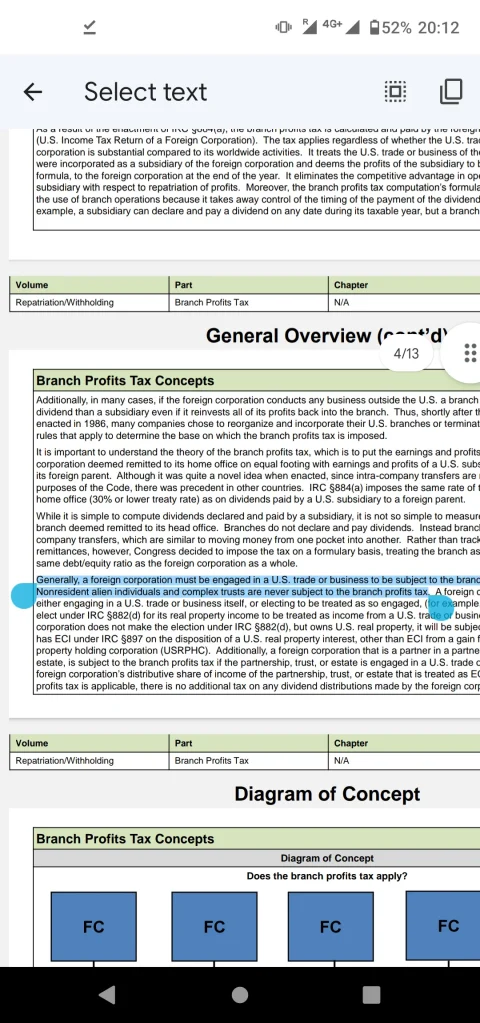

My lawyer never mentioned this. Wether it's owned by a foreign person or entity, it would be a single member LLC. Income not generated while in the US would not be US source income. Have spoken with 2 lawyers and neither one said anything about branch profit ? Please any links would be great. I found this which I don't meet these conditions since the work is being performed outside of the United States which means it's not ECI . Also I do not have any operations in the US and no permanent establishment. What do you think ?There's a risk of the IRS saying you have US-source income anyway.

If the US LLC is owned by a foreign company (like your UAE company), then there is the risk of 30% branch profit tax on top.

So far I haven't met anyone who was actually affected by this, but I've spoken to US tax experts and they said it's a real risk.

The foreign corporation is engaged in a trade or business in the United States. This includes owning real estate.

The foreign corporation has income from business activities or holdings in the United States. This is known as effectively connected income. For example, making money on the sale of U.S. real estate results in effectively connected income.

Last edited:

Wether it's owned by a foreign person or entity, it would be a single member LLC. Income not generated while in the US would not be US source income. Have spoken with 2 lawyers and neither one said anything about branch profit ? Please any links would be great.

Branch profit tax applies if you have ECI only. If the US LLC is owned by an individual, then there is only tax on the ECI.

But if you have ECI and the US LLC is owned by a company and you transfer money out to the owner of the US LLC - then the branch profit tax applies. It's similar to a withholding tax.

Imagine that a UAE company owned a a US LLC that was operating a restaurant in Miami (no state taxes).

Scenario 1:

The US LLC is taxed as a corporation and makes a $1M profit. It pays the 21% CIT (hope I'm correct about the federal CIT rate). The remaining $790k are paid as a dividend to the parent company. There's no tax treaty, so a 30% withholding tax ($237k) applies. Only $553k can be paid out to the UAE parent company.

Scenario 2:

The US LLC is taxed as a disregarded entity (tax-transparent) and makes a $1M profit. There's obviously ECI (it's a restaurant), so the profit is subject to the same 21% CIT. But except for the ECI, it's tax transparent, so there are no dividends to pay out, so withholding tax on dividends doesn't apply. Without a branch profit tax, the after-tax profit of $790k can be transferred to the UAE parent company without any additional tax withholding.

That's what they wanted to fix because scenario 2 suddenly came with a massive tax advantage. So the branch profit tax was introduced, which simply puts the same withholding tax (additional 30% tax) on any money that is transferred out to the parent company, like a dividend. It's not a dividend though, that's why they call it the "dividend-equivalent amount".

So if you have ECI, it's a double whammy situation if the US LLC is owned by a company instead of an individual.

Just google it, there's a lot of info about it, e.g. this:

https://klasing-associates.com/question/branch-profits-tax/

However, there's also at least one positive with a company owning the US LLC: You can avoid the US estate tax.

If you die and you're the direct owner of the US LLC, then there would be US estate tax, at least on all US assets. I'm not sure if the value of the LLC itself would also fall under that.

If you die as the owner of the foreign company owning the US LLC, then the US LLC wouldn't be impacted at all.

I found this which I don't meet these conditions since the work is being performed outside of the United States which means it's not ECI . Also I do not have any operations in the US and no permanent establishment. What do you think ?

Yes, that's the theory. And I've heard that it works perfectly fine like this for a lot of people.

However, if you have US business clients, they only see a US company. And they may send a form 1099 (if I remember correctly), because that's what they would have to do for a US supplier.

They will send a copy to the IRS and say "This US company is doing business for us, a US client". It's not your client's job to assess your tax status. You're a US supplier as far as they are concerned.

From what I understood, the purpose of this is to make it harder to evade taxes.

Basically your client reports your income to the IRS for you "We paid this US company $50k for their work".

Then the IRS will notice "So this US company earned $50k from this US client.... Why didn't they pay any taxes?" (Note that the company being owned by a non-resident alien doesn't automatically mean there was no ECI, as in scenario 2 above.)

So now the IRS may come looking for that tax. Or, to put it simply, they may simply assume/claim that there was ECI and then you would have to fight them about it.

And I guess in states like California, the IRS may be extra aggressive.

Yes, it sounded weird for me as well, but that's what both a very reputable (=expensive) US tax lawyer and also a CPA told me. They said it might make more sense to use the US LLC only to market to US clients and then bill from a foreign company (and not the same company that owns the US LLC).

See also this part about form 1099:

https://www.upcounsel.com/when-to-issue-a-1099https://watkinsandco.com/accountant...s-you-need-to-know-as-a-small-business-owner/

You see that your US clients will have to send them. And then the IRS may eventually come asking why you didn't pay the tax.

Maybe they will accept your explanation that what you did wasn't ECI... or maybe they won't. I have no real life experience, so I have no idea how big this risk is.

I've head of a lot of people doing this without any issues. But the tax lawyer really didn't think it's a good idea. (He did think it's a good idea to use a US LLC to bill non-US clients, however.)

Last edited:

Thanks for the explanation and detail.Branch profit tax applies if you have ECI only. If the US LLC is owned by an individual, then there is only tax on the ECI.

But if you have ECI and the US LLC is owned by a company and you transfer money out to the owner of the US LLC - then the branch profit tax applies. It's similar to a withholding tax.

Imagine that a UAE company owned a a US LLC that was operating a restaurant in Miami (no state taxes).

Scenario 1:

The US LLC is taxed as a corporation and makes a $1M profit. It pays the 21% CIT (hope I'm correct about the federal CIT rate). The remaining $790k are paid as a dividend to the parent company. There's no tax treaty, so a 30% withholding tax ($237k) applies. Only $553k can be paid out to the UAE parent company.

Scenario 2:

The US LLC is taxed as a disregarded entity (tax-transparent) and makes a $1M profit. There's obviously ECI (it's a restaurant), so the profit is subject to the same 21% CIT. But except for the ECI, it's tax transparent, so there are no dividends to pay out, so withholding tax on dividends doesn't apply. Without a branch profit tax, the after-tax profit of $790k can be transferred to the UAE parent company without any additional tax withholding.

That's what they wanted to fix because scenario 2 suddenly came with a massive tax advantage. So the branch profit tax was introduced, which simply puts the same withholding tax (additional 30% tax) on any money that is transferred out to the parent company, like a dividend. It's not a dividend though, that's why they call it the "dividend-equivalent amount".

So if you have ECI, it's a double whammy situation if the US LLC is owned by a company instead of an individual.

Just google it, there's a lot of info about it, e.g. this:

https://klasing-associates.com/question/branch-profits-tax/

However, there's also at least one positive with a company owning the US LLC: You can avoid the US estate tax.

If you die and you're the direct owner of the US LLC, then there would be US estate tax, at least on all US assets. I'm not sure if the value of the LLC itself would also fall under that.

If you die as the owner of the foreign company owning the US LLC, then the US LLC wouldn't be impacted at all.

Yes, that's the theory. And I've heard that it works perfectly fine like this for a lot of people.

However, if you have US business clients, they only see a US company. And they may send a form 1099 (if I remember correctly), because that's what they would have to do for a US supplier.

They will send a copy to the IRS and say "This US company is doing business for us, a US client". It's not your client's job to assess your tax status. You're a US supplier as far as they are concerned.

From what I understood, the purpose of this is to make it harder to evade taxes.

Basically your client reports your income to the IRS for you "We paid this US company $50k for their work".

Then the IRS will notice "So this US company earned $50k from this US client.... Why didn't they pay any taxes?" (Note that the company being owned by a non-resident alien doesn't automatically mean there was no ECI, as in scenario 2 above.)

So now the IRS may come looking for that tax. Or, to put it simply, they may simply assume/claim that there was ECI and then you would have to fight them about it.

And I guess in states like California, the IRS may be extra aggressive.

Yes, it sounded weird for me as well, but that's what both a very reputable (=expensive) US tax lawyer and also a CPA told me. They said it might make more sense to use the US LLC only to market to US clients and then bill from a foreign company (and not the same company that owns the US LLC).

So firstly, a restaurant is a physical presence and clearly operating in the US.

I would be doing remote work from abroad so this applies the same way ?

If they submit a 1099 as a US supplier, because yes, I am invoicing them from my US LLC, the profit there is pass through to my corp tax residency . How is everyone else doing this ?

Branch profits do not apply to foreign owned single member LLC. It's in the rules. No work, equipment, offices or employees on the ground in US = no branch profits tax. Doesn't matter where your clients are based as long as you have no substance in US. Been told this by at least 5 tax accountants

Attachments

So firstly, a restaurant is a physical presence and clearly operating in the US.

Guess why I picked that example?

I would be doing remote work from abroad so this applies the same way ?

If you have no ECI, no. If you have ECI, yes.

Branch profits do not apply to foreign owned single member LLC.

That is false. Branch profit tax ONLY applies to foreign-owned LLCs (foreign owned LLCs that are owned by a foreign corporation, to be exact).

No work, equipment, offices or employees on the ground in US = no branch profits tax.

No. No ECI = no branch profits tax.

According to the tax lawyer and CPA I spoke to (I am not making this up!), there is a risk that the IRS could simply claim you have ECI. And then you will have to fight them.

Here's what they told me:

If you came in rarely for client meetings, the IRS would argue first that the LLC is engaged in a trade or business in the US through you, so it has US ECI and that you should be subject to US tax on that income. It is not likely they would pick up on rare visits, but if your customers started filing information returns supporting the payment of fees to the LLC for services, the IRS would look to see how that income is being taxed, and then we get into the argument we would rather avoid. The US customer has no obligation to file an information return for payments to a foreign contractor, but the LLC is a US contractor, so they would want to file a Form 1099

[...]

US customers will file 1099s for payments made to US entities like a US LLC. So to avoid that it would be better to bill the services through another foreign company. Once you get into the US tax system, the computer starts asking questions. Client A has filed a 1099 for $10,000. Where is that picked up. We don’t see it, and they send the LLC a form letter saying you have unreported income. We say No because there is no ECI. The IRS might accept that, but they might not and start digging. If you can show you spent 1 day in the US, you would have a good argument that only income associated with that day is ECI, but if I were an IRS agent I would try for more. We escape all that if the billing goes through a foreign corporation for which no 1099 is necessary

And from the CPA:

If the US LLC is billing US clients, it could be deemed that the US LLC has US source income and is subject to US taxation.

Make of that what you want.

Yes, a lot of people are fine with such a setup, despite billing US clients. I only pointed out the risk. And if you are deemed to have ECI (whether you agree or not), then you will have branch profits tax on top of it if the LLC is owned by a company instead of by you personally. That's it.

Scenario 2:

The US LLC is taxed as a disregarded entity (tax-transparent) and makes a $1M profit. There's obviously ECI (it's a restaurant), so the profit is subject to the same 21% CIT. But except for the ECI, it's tax transparent, so there are no dividends to pay out, so withholding tax on dividends doesn't apply. Without a branch profit tax, the after-tax profit of $790k can be transferred to the UAE parent company without any additional tax withholding.

That's what they wanted to fix because scenario 2 suddenly came with a massive tax advantage.

Btw, I believe this is why some say that a branch of a foreign company can be a good deal if you have local presence.

I think it was @Marzio who was recommending having a Swiss branch of a foreign company? I would imagine you pay the 10% or so in corporate income tax (depending on where you register your branch) and then you'd avoid the 35% Swiss withholding tax with such a setup. But I'm not sure.

Last edited:

I think it was @Marzio who was recommending having a Swiss branch of a foreign company? I would imagine you pay the 10% or so in corporate income tax (depending on where you register your branch) and then you'd avoid the 35% Swiss withholding tax with such a setup.

To give credit where credit's due this was first mentioned by @ffbkdavid in this thread

Yeah, it's as I described then. Basically how it was in the US before the branch profits tax was implemented.

But there is a risk of double taxation, of having to pay tax both in the country where the branch is located, and in the country where the company has its head office.

I believe especially for multinational insurance companies it is very common to operate with branches because there are some tax advantages for them, but I don't remember the details.

But there is a risk of double taxation, of having to pay tax both in the country where the branch is located, and in the country where the company has its head office.

I believe especially for multinational insurance companies it is very common to operate with branches because there are some tax advantages for them, but I don't remember the details.

I have also asked 3 lawyers so far they all say it's not us source income no ECI, no branch tax. This is really throwing me off what these guys are saying. I have another scheduled call with a diff lawyer now wasting money to rest my anxietyBranch profits do not apply to foreign owned single member LLC. It's in the rules. No work, equipment, offices or employees on the ground in US = no branch profits tax. Doesn't matter where your clients are based as long as you have no substance in US. Been told this by at least 5 tax accountants

Guess why I picked that example?

If you have no ECI, no. If you have ECI, yes.

That is false. Branch profit tax ONLY applies to foreign-owned LLCs (foreign owned LLCs that are owned by a foreign corporation, to be exact).

No. No ECI = no branch profits tax.

According to the tax lawyer and CPA I spoke to (I am not making this up!), there is a risk that the IRS could simply claim you have ECI. And then you will have to fight them.

Here's what they told me:

If you came in rarely for client meetings, the IRS would argue first that the LLC is engaged in a trade or business in the US through you, so it has US ECI and that you should be subject to US tax on that income. It is not likely they would pick up on rare visits, but if your customers started filing information returns supporting the payment of fees to the LLC for services, the IRS would look to see how that income is being taxed, and then we get into the argument we would rather avoid. The US customer has no obligation to file an information return for payments to a foreign contractor, but the LLC is a US contractor, so they would want to file a Form 1099

[...]

US customers will file 1099s for payments made to US entities like a US LLC. So to avoid that it would be better to bill the services through another foreign company. Once you get into the US tax system, the computer starts asking questions. Client A has filed a 1099 for $10,000. Where is that picked up. We don’t see it, and they send the LLC a form letter saying you have unreported income. We say No because there is no ECI. The IRS might accept that, but they might not and start digging. If you can show you spent 1 day in the US, you would have a good argument that only income associated with that day is ECI, but if I were an IRS agent I would try for more. We escape all that if the billing goes through a foreign corporation for which no 1099 is necessary

And from the CPA:

If the US LLC is billing US clients, it could be deemed that the US LLC has US source income and is subject to US taxation.

Make of that what you want.

Yes, a lot of people are fine with such a setup, despite billing US clients. I only pointed out the risk. And if you are deemed to have ECI (whether you agree or not), then you will have branch profits tax on top of it if the LLC is owned by a company instead of by you personally. That's it.

Btw, I believe this is why some say that a branch of a foreign company can be a good deal if you have local presence.

I think it was @Marzio who was recommending having a Swiss branch of a foreign company? I would imagine you pay the 10% or so in corporate income tax (depending on where you register your branch) and then you'd avoid the 35% Swiss withholding tax with such a setup. But I'm not sure.

I have another call with a lawyer this week to confirm what you are saying. I sent them an email they responded with no US tax or branch tax. I will dig in more. They also said definitely no if the US Corp is registered in personal name and not the UAE LLC. But even with UAE LLC likely no branch tax due to no ECI

Last edited:

Just to sum it up. For there to be branch profit tax, three requirements must be fulfilled:

1. ECI

2. The US LLC must be owned by a company (not an individual)

3. Payment to parent company (no BPT is due on money that is reinvested in the US)

As soon as one of the three criteria isn't met, there is no BPT.

If you only work outside the US, there shouldn't be any ECI - in theory.

The risk that my tax lawyer was seeing was that your clients would notify the IRS about your revenue from US clients (form 1099).

This could raise questions with the IRS and they could come looking for the tax - and simply claim you have ECI. Then you would have to prove you didn't have any ECI.

Say you were in the US for a couple of meetings with your clients - boom, risk of ECI.

Maybe you have a server in the US (maybe you manage your client's IT infrastructure?) - potentially a risk of ECI (not sure about the US - but in some countries, even a server can constitute a PE).

If you've ever worked internationally, then you know that what is written on paper and how things are handled in practice can differ a lot. I know a guy who was living in two high-tax countries at the same time, he was audited and it cost him $20k in lawyer fees just to help the relevant tax authorities, in which of the two countries he should be paying his 50%+ in taxes.

So what my lawyer was saying - if you want completely to avoid that risk, better don't charge your US clients from your US LLC. Maybe use it to market to US clients, but then bill from a company that isn't related to the US LLC in any way (i.e. don't use the company that owns the US LLC).

Then you completely avoid this risk.

I know that a lot of people successfully use US LLCs with US clients and don't pay any taxes in the US, exactly like you're saying.

But I also understand why the lawyer emphasized this risk.

Unfortunately, I think nobody can really tell you if this is a 0.00001%, 1% or 50% risk. I would also guess it will depend on how much business you do in the US.

Please share what your contact tells you - I haven't consulted with any other lawyers. It's not my intent to scare anybody, I'm simply relaying the information I received (and paid a lot of money for).

1. ECI

2. The US LLC must be owned by a company (not an individual)

3. Payment to parent company (no BPT is due on money that is reinvested in the US)

As soon as one of the three criteria isn't met, there is no BPT.

If you only work outside the US, there shouldn't be any ECI - in theory.

The risk that my tax lawyer was seeing was that your clients would notify the IRS about your revenue from US clients (form 1099).

This could raise questions with the IRS and they could come looking for the tax - and simply claim you have ECI. Then you would have to prove you didn't have any ECI.

Say you were in the US for a couple of meetings with your clients - boom, risk of ECI.

Maybe you have a server in the US (maybe you manage your client's IT infrastructure?) - potentially a risk of ECI (not sure about the US - but in some countries, even a server can constitute a PE).

If you've ever worked internationally, then you know that what is written on paper and how things are handled in practice can differ a lot. I know a guy who was living in two high-tax countries at the same time, he was audited and it cost him $20k in lawyer fees just to help the relevant tax authorities, in which of the two countries he should be paying his 50%+ in taxes.

So what my lawyer was saying - if you want completely to avoid that risk, better don't charge your US clients from your US LLC. Maybe use it to market to US clients, but then bill from a company that isn't related to the US LLC in any way (i.e. don't use the company that owns the US LLC).

Then you completely avoid this risk.

I know that a lot of people successfully use US LLCs with US clients and don't pay any taxes in the US, exactly like you're saying.

But I also understand why the lawyer emphasized this risk.

Unfortunately, I think nobody can really tell you if this is a 0.00001%, 1% or 50% risk. I would also guess it will depend on how much business you do in the US.

Please share what your contact tells you - I haven't consulted with any other lawyers. It's not my intent to scare anybody, I'm simply relaying the information I received (and paid a lot of money for).

Thanks and I appreciate that.Just to sum it up. For there to be branch profit tax, three requirements must be fulfilled:

1. ECI

2. The US LLC must be owned by a company (not an individual)

3. Payment to parent company (no BPT is due on money that is reinvested in the US)

As soon as one of the three criteria isn't met, there is no BPT.

If you only work outside the US, there shouldn't be any ECI - in theory.

The risk that my tax lawyer was seeing was that your clients would notify the IRS about your revenue from US clients (form 1099).

This could raise questions with the IRS and they could come looking for the tax - and simply claim you have ECI. Then you would have to prove you didn't have any ECI.

Say you were in the US for a couple of meetings with your clients - boom, risk of ECI.

Maybe you have a server in the US (maybe you manage your client's IT infrastructure?) - potentially a risk of ECI (not sure about the US - but in some countries, even a server can constitute a PE).

If you've ever worked internationally, then you know that what is written on paper and how things are handled in practice can differ a lot. I know a guy who was living in two high-tax countries at the same time, he was audited and it cost him $20k in lawyer fees just to help the relevant tax authorities, in which of the two countries he should be paying his 50%+ in taxes.

So what my lawyer was saying - if you want completely to avoid that risk, better don't charge your US clients from your US LLC. Maybe use it to market to US clients, but then bill from a company that isn't related to the US LLC in any way (i.e. don't use the company that owns the US LLC).

Then you completely avoid this risk.

I know that a lot of people successfully use US LLCs with US clients and don't pay any taxes in the US, exactly like you're saying.

But I also understand why the lawyer emphasized this risk.

Unfortunately, I think nobody can really tell you if this is a 0.00001%, 1% or 50% risk. I would also guess it will depend on how much business you do in the US.

Please share what your contact tells you - I haven't consulted with any other lawyers. It's not my intent to scare anybody, I'm simply relaying the information I received (and paid a lot of money for).

Although I will have a UAE LLC I will not register that as the owner of the US LLC to be safe and keep in my personal name.

I do have a few meetings a year in the US which I will rethink now, and my lawyers response to that was make sure to not sign and formalize any agreements while in the US.

And if you do have to pay tax it would be prorated for the days there , now will that mean I have ECI ? He didn't think so. I will conform this again though.

Will report back soon

Yeah, I think the problem is that ECI/ETBUS ("engaged in a trade or business in the US") is a very vague concept.

Basically anything happening physically in the US is a potential risk. And then even if they only attribute ECI to the days spent in the US - what is the value of those meetings? An aggressive IRS agent could probably say that, without the meeting, you wouldn't have received that $365k contract. So the ECI is not simply 1/365 (1 day out of 365 per year), but it should be something higher, maybe 20% of the contract sum? That's the risk.

If there is ECI, then there will be US tax in any case - the BPT would be on top of that.

Then there's the UAE side on top of it all:

If the US LLC is owned by the UAE company, then it would probably count as income of the UAE company in the UAE, as if the income was earned by the UAE company directly. So if you have a freezone company, it would probably count as income of that freezone company.

However, if you own the US LCC in your own name, then in theory, the UAE could say that your US LLC has a mainland PE in the UAE and that it's basically a mainland company that is completely separate from your freezone company (and if you didn't register for corporate tax, then you risk fines on top of UAE corporate tax). That seems rather far-fetched at the moment, but the new corporate tax rules in the UAE are as clear as mud at the moment.

I think it would probably be best to await further clarifications from the UAE tax authority. Until then, I see two potential solutions to avoiding the tax risk in the UAE:

1. Own the US LLC under your personal name, but register a freezone branch of the US LLC, instead of a UAE company, so it's clear how the US LLC should be handled in the UAE.

This might be a better solution anyway as your company would (hopefully) mostly fall under US law and not UAE law (liability etc.).

2. Add a nominee manager to your US LLC. That person should be in a tax-free country or a territorial tax country with very weak enforcement of PE rules. Then, if the UAE tax authorities really should come asking, you could explain that you are not managing the US LLC from the UAE, but that you're just a passive investor. (Can't really imagine they will come asking anytime soon, but if they do, I really can't imagine they'll start questioning your substance outside the UAE...) This approach would also completely avoid the headache with salary, corporate tax etc. - you're just a passive investor, no work is happening in the UAE, no PE, nothing... But that would also mean you'd need some other way to get your visa (like a Golden Visa or a separate freelancer license, or something like that).

It's all quite a mess at the moment, unfortunately.

Basically anything happening physically in the US is a potential risk. And then even if they only attribute ECI to the days spent in the US - what is the value of those meetings? An aggressive IRS agent could probably say that, without the meeting, you wouldn't have received that $365k contract. So the ECI is not simply 1/365 (1 day out of 365 per year), but it should be something higher, maybe 20% of the contract sum? That's the risk.

If there is ECI, then there will be US tax in any case - the BPT would be on top of that.

Then there's the UAE side on top of it all:

If the US LLC is owned by the UAE company, then it would probably count as income of the UAE company in the UAE, as if the income was earned by the UAE company directly. So if you have a freezone company, it would probably count as income of that freezone company.

However, if you own the US LCC in your own name, then in theory, the UAE could say that your US LLC has a mainland PE in the UAE and that it's basically a mainland company that is completely separate from your freezone company (and if you didn't register for corporate tax, then you risk fines on top of UAE corporate tax). That seems rather far-fetched at the moment, but the new corporate tax rules in the UAE are as clear as mud at the moment.

I think it would probably be best to await further clarifications from the UAE tax authority. Until then, I see two potential solutions to avoiding the tax risk in the UAE:

1. Own the US LLC under your personal name, but register a freezone branch of the US LLC, instead of a UAE company, so it's clear how the US LLC should be handled in the UAE.

This might be a better solution anyway as your company would (hopefully) mostly fall under US law and not UAE law (liability etc.).

2. Add a nominee manager to your US LLC. That person should be in a tax-free country or a territorial tax country with very weak enforcement of PE rules. Then, if the UAE tax authorities really should come asking, you could explain that you are not managing the US LLC from the UAE, but that you're just a passive investor. (Can't really imagine they will come asking anytime soon, but if they do, I really can't imagine they'll start questioning your substance outside the UAE...) This approach would also completely avoid the headache with salary, corporate tax etc. - you're just a passive investor, no work is happening in the UAE, no PE, nothing... But that would also mean you'd need some other way to get your visa (like a Golden Visa or a separate freelancer license, or something like that).

It's all quite a mess at the moment, unfortunately.

Last edited:

Share:

Latest Threads

-

What to Know About Getting a Checking Account That Does Not Require SSN

- Started by Kim-OTC

- Replies: 0

-

HMRC closing its online filing service 31 March 2026

- Started by aragon

- Replies: 4

-

-

How to Open a Bank Account in Mexico for Residents & Non-Residents

- Started by Kim-OTC

- Replies: 0

-

How Do You Open a Bank Account? Requirements, Considerations & Precautions

- Started by Kim-OTC

- Replies: 0