Hey kekmaw at which banks did you open accounts in UAE? I opened at both Mashreq and NBD but I hesitate to fund the NBD one because of lots of bad comments I read about them on the internet.I have a FZE in a UAE yeah. Pretty easy to setup if you go with a agent to help you... also helps you get introduced to banks etc. If you want a offshore company, it's pretty hard to get a bank account from what I've heard... unless you know someone.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone with experience of a UAE FZ company?

- Thread starter kekmaw

- Start date

Yes I'm required to stay outside of my home country for at least 6 months of the year + some other stuff in order to not be tax liable back home.

But, if I don't stay outside of my home country for 6 months of the year and wanted to do offshore tax planning... I would likely have to break laws or do even more expensive solutions in order to be covered. So, in most cases, if you want to do everything legally and be free like a bird, you will probably have to get residency in another country and not spend to much time back home.

Personally, I don't even want to stay in my hone country for more than 6 months a year so works fine! It's about exploring the world guys!

If you stay outside the country for 6 months you will have relief in personal tax but your company is considered resident of your home country as you own 100 percent shares coz it is is a freezone company so you are liable to file returns and your profits are taxed in your home country so freezone wouldn't help you.

are you sure about this? I asked my tax office and they could not be clear on thisIf you stay outside the country for 6 months you will have relief in personal tax but your company is considered resident of your home country as you own 100 percent shares coz it is is a freezone company so you are liable to file returns and your profits are taxed in your home country so freezone wouldn't help you.

What bank account would you recommend for an UAE FZE company doing affiliate marketing?

Relatively small amounts so I don't need something fancy, just something that works.

For a) EU citizen b) non-EU citizen (both being resident in UAE)

Also another "problem" I need to solve is cashing out some crypto. It's fully legal, I just bought some early, then sold and now I have the money on exchange under my name.

It's nothing shady, I was just a bit lucky by buying a few coins that exploded in price but I'm really afraid the banks will think I'm a terrorist or selling child videos or coding randomware and stuff like that.

I assume it's a good problem to have but still, I feel that if I wired some money from a crypto exchange to an account in UAE (where it could be haram) or to a bank account in my home country, the guys in the bank would go crazy and they would report me to tax authorities, to police and on top of that bounce the payment back...

I don't want to mix these two things (affiliate marketing and crypto) together as it could cause problems. So I assume a good solution would be to have multiple accounts or multiple EMIs.

If you want to keep it secret, you can PM me if necessary.

Relatively small amounts so I don't need something fancy, just something that works.

For a) EU citizen b) non-EU citizen (both being resident in UAE)

Also another "problem" I need to solve is cashing out some crypto. It's fully legal, I just bought some early, then sold and now I have the money on exchange under my name.

It's nothing shady, I was just a bit lucky by buying a few coins that exploded in price but I'm really afraid the banks will think I'm a terrorist or selling child videos or coding randomware and stuff like that.

I assume it's a good problem to have but still, I feel that if I wired some money from a crypto exchange to an account in UAE (where it could be haram) or to a bank account in my home country, the guys in the bank would go crazy and they would report me to tax authorities, to police and on top of that bounce the payment back...

I don't want to mix these two things (affiliate marketing and crypto) together as it could cause problems. So I assume a good solution would be to have multiple accounts or multiple EMIs.

If you want to keep it secret, you can PM me if necessary.

Hey kekmaw at which banks did you open accounts in UAE? I opened at both Mashreq and NBD but I hesitate to fund the NBD one because of lots of bad comments I read about them on the internet.

Kinda slow response here but I ended up with Mashreq. If I were to open a new bank account now I'll probably go with ADCB.

If you stay outside the country for 6 months you will have relief in personal tax but your company is considered resident of your home country as you own 100 percent shares coz it is is a freezone company so you are liable to file returns and your profits are taxed in your home country so freezone wouldn't help you.

Nothing in that statement is true.

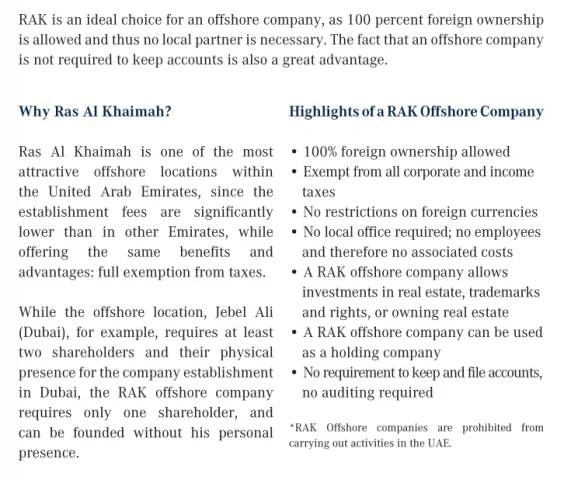

How about UAE RAK (Ras al-Khaimah) offshore companies? The setup and maintenance fees seem to be much lower, a few 1000's of dollars. Zero taxes, lots of privacy, no requirement to file accounts & audits.

I'm looking to set up an offshore company for trading shares via an online broker. This seems to fit the bill, and I would not be living in UAE/Dubai.

I'm looking to set up an offshore company for trading shares via an online broker. This seems to fit the bill, and I would not be living in UAE/Dubai.

Are you sure about that? Are you sure they don't exchange information?no requirement to file accounts & audits.

Good structure. Do you need to actually file a patent for your asset/idea to be able to do this?

I have a construction business which is registered in Cyprus, working in Sweden with a permanent establishment and trying to find out a way to pay less taxes. So far I could optimize it with the parent company of the Cyprus company which is registered in the UAE. So I transferred most of the revenue there and the parent company paid all the operation related expenses..

Now I bumped into the same problem as some of us, the Cyprus bank is closing my account in November and I need to find another one. Which is hard with the fact that the parent company is registered in UAE..

I have a construction business which is registered in Cyprus, working in Sweden with a permanent establishment and trying to find out a way to pay less taxes. So far I could optimize it with the parent company of the Cyprus company which is registered in the UAE. So I transferred most of the revenue there and the parent company paid all the operation related expenses..

Now I bumped into the same problem as some of us, the Cyprus bank is closing my account in November and I need to find another one. Which is hard with the fact that the parent company is registered in UAE..

Are you sure about that? Are you sure they don't exchange information?

I am not sure about anything. I am not an expert and have no practical experience. So I have to rely on whatever I find on the web, mostly marketing material. Attached is a screen capture of some benefits of an RAK offshore company, according to one source. Those companies are IBCs, not LLCs.

By "exchange of information" you mean exactly what? UAE financial institutions are part of AEOI, but you don't have to set up your company bank account in UAE. Regarding keeping & filing accounts, there's some conflicting information. Some, like the attached source, say you do not have to keep and file accounts. Others say you have to keep accounts, but since there is no requirement for filing them & not audits, it's up to you.

Attachments

How about UAE RAK (Ras al-Khaimah) offshore companies? The setup and maintenance fees seem to be much lower, a few 1000's of dollars. Zero taxes, lots of privacy, no requirement to file accounts & audits.

I'm looking to set up an offshore company for trading shares via an online broker. This seems to fit the bill, and I would not be living in UAE/Dubai.

I'm yet to setup a offshore company in the UAE, I've only done Freezone. But from what I've heard, it's very hard to get a bank account in the UAE with a offshore company unless you already have a good relationship with a bank there or are willing to deposit a bigger chunk of cash. I'm about to setup an offshore company later this year most likely though so I'll know better then. I have a bank with a branch in Dubai that said it would not be a problem with them though.

hey @kekmaw, i'm glad i found your thread! I'm planning to setup a company in dubai in the next few months, may i ask you what were your total expenses for setting up the business in the free zone? and what are they now? thanks so much!

It probably costed about €12k the first year with the setup fees and stuff and then €5-7k every following year.

It probably costed about €12k the first year with the setup fees and stuff and then €5-7k every following year.

Which Freezone did you setup your company in? Did you choose a virtual office/shared desk or a private office? As I heard it is hard to have a bank account opened with shared desk...

Which Freezone did you setup your company in? Did you choose a virtual office/shared desk or a private office? As I heard it is hard to have a bank account opened with shared desk...

Flex Desk office and Ajman FZE.

Yeah every year since I setup my business I've heard it's getting harder and harder (especially if you work with little capital). If you are a high-value customer, most banks will probably be happy to take you though. Otherwise you'll have to be careful with which agent you setup the business with as they are the people with relationships with banks already that will usually help you through the door.

A small tip tough: There are non-UAE banks (Lebanese to be specific) with offices (not even a "branch") in the UAE that in some cases are very easy to setup with regardless of what kind of company you are running.

are you enjoying yourself in Dubai?Flex Desk office and Ajman FZE.

Yeah every year since I setup my business I've heard it's getting harder and harder (especially if you work with little capital). If you are a high-value customer, most banks will probably be happy to take you though. Otherwise you'll have to be careful with which agent you setup the business with as they are the people with relationships with banks already that will usually help you through the door.

A small tip tough: There are non-UAE banks (Lebanese to be specific) with offices (not even a "branch") in the UAE that in some cases are very easy to setup with regardless of what kind of company you are running.

I mean are you fidning it difficult to living there instead of your home country? Maybe there is something about the city that one should know before moving there

are you enjoying yourself in Dubai?

I mean are you fidning it difficult to living there instead of your home country? Maybe there is something about the city that one should know before moving there

Dubai is a great hub to live in to be honest.

I've been traveling to 25 or so countries and if I were to live in one of them for a decent amount of time per year, it would be Dubai.

It's one of the most modern places you'll ever visit and it has everything you need and it's clean and safe.

While I wouldn't wanna live here year around (hate the hot and humid summers), it's a great place for a few months at a time.

I was visiting Cyprus earlier this year to kind of compare it as it was an alternative to move to when I setup this business and I'm so happy I didn't end up doing that. It's not modern, internet sucks and the buildings are cold unless it's summer. Small things like that but you won't have to deal with that in Dubai, they got their s**t together.

I've also setup company in UAE and residency in Dubai. The funny thing is that I was not looking forward living in Dubai AT ALL, and it was a pure business decision. And we would be traveling most part of the year anyway.

I had to get used to how the folks over there think and handle things, since a lot of workers are from India, Philipines etc. so compared with EU they really lack logical thinking (smh).

But other than that I really started to Like Dubai, and now I enjoy being there. There are a lot of amazing food restaurants, hotels where you can chill, shopping malls where you can find anything you need, etc.

I'm happy I took this decision. If your business is doing some volume than it's a no brainer to live there with 0%(!!!) income tax.

We travel a lot and we stay around 4 to 6 months a year in Dubai, but you don't have to as long as you visit it 2 times a year. (Ofcourse don't go "live" in Dubai and than go back to your home country to stay there. That goes without saying )

I had to get used to how the folks over there think and handle things, since a lot of workers are from India, Philipines etc. so compared with EU they really lack logical thinking (smh).

But other than that I really started to Like Dubai, and now I enjoy being there. There are a lot of amazing food restaurants, hotels where you can chill, shopping malls where you can find anything you need, etc.

I'm happy I took this decision. If your business is doing some volume than it's a no brainer to live there with 0%(!!!) income tax.

We travel a lot and we stay around 4 to 6 months a year in Dubai, but you don't have to as long as you visit it 2 times a year. (Ofcourse don't go "live" in Dubai and than go back to your home country to stay there. That goes without saying )

Share:

Latest Threads

-

-

-

Switzerland - branch office or local GmbH

- Started by DomOCT

- Replies: 6