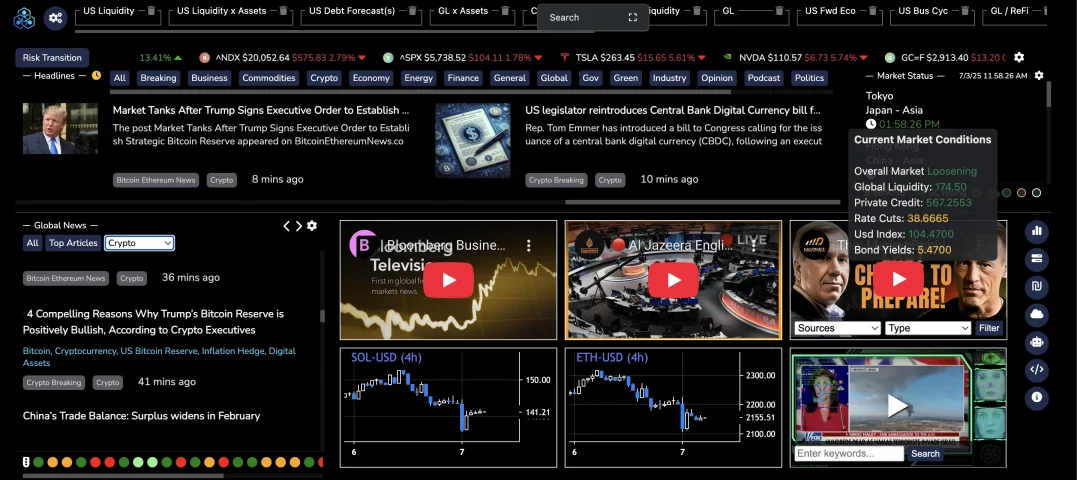

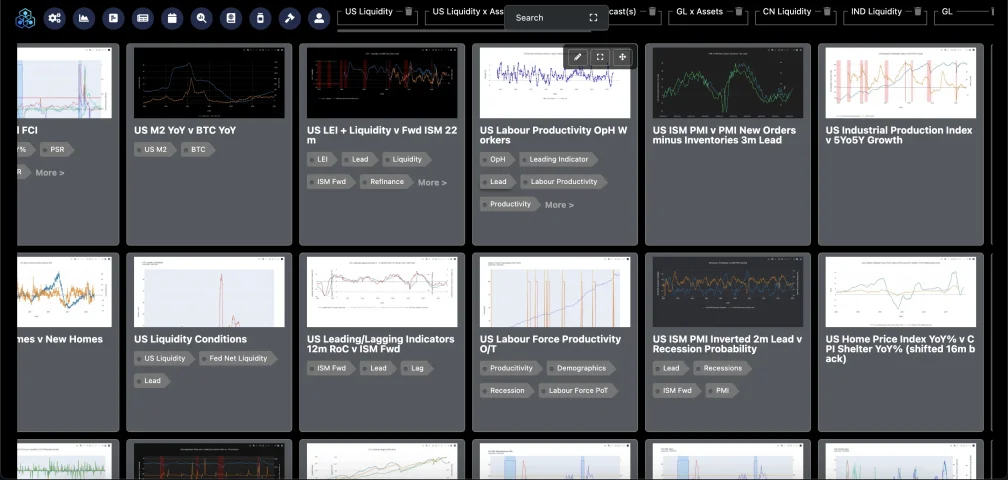

We have a internal system, over the past year been trying to make it accessible front end (external) - getting there - so these above are the external representations - slightly less technical etc but does the same job.are these tools something you developed internally in your company @wellington ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Total return by asset for last 200 years

- Thread starter uranium

- Start date

this one yeah?Source: "Stocks for the Long Run" by Jeremy Siegel.

https://www.amazon.com/Stocks-Long-Run-Definitive-Investment/dp/0071800514

Thank for sharing. I was wondering if you posted any recent charts?Now for those that still wish to believe in the fairy tale of free-markets and it's all driven by wild productivity that can not be surmised, guessed, predicted pre-emptively.

(US Stocks)

US Consumer Price Index (CPI) - 1990 (this was technically the first cross over period) vs 6 Months annualised % change .... looks random right. View attachment 6874

Now look at US PPI Minus CPI vs Corporate Profits after Tax.

Oh that's weird - they are synchronised... hmmmmmm...

View attachment 6875

Well, PPI lags CPI, & CPI is a lagging impact on the markets and led by the business cycle and as we can see business cycle profits minus taxes follows PPI, and all of these follow the ISM in a manner of speaking, the ISM... therefore is the next area you need to peruse.

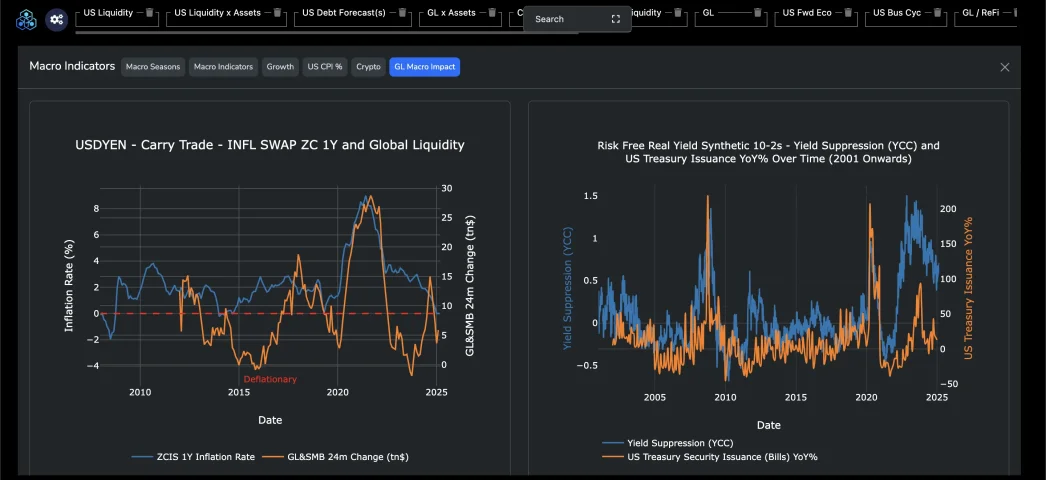

Observe ISM (US ISM Follows China Credit Liquidity Impulse by 6 months - and follows Global Liquidity by roughly 15-18 months) -> but CB Liquidity takes 52 weeks to hit Global Liquidity -> then from there weeks to months into the markets.

Note 2018 onwards... that was the last breakage in the system (2018/19 rate hike attempt).

View attachment 6878

Global Liquidity Cycles

View attachment 6879

Correlation between Central Bank Value (FED) and Nasdaq (= Nasdaq is lifted by Fed Balance Sheet) -> Fed tightens to pull in funds to roll over debts every X yrs to service the interest at a lower rate i.e it crowds out the markets to pull in liquidity -> hence pull backs Nasdaq etc (mentioned above) time those periods against rate hikes you have your answer, then observe liquidity flows.

View attachment 6880

G7 as synchronised (they all follow papa bear). oh look you can clearly see the future... you can also show the past, as ISM leads... you know where the markets go in the future as the inverted value as its all re-financing provides a path to a cycle of the past and the future....

View attachment 6881

Now you can go into the US Markets specifically ISM, PMI's vrs their respected Inverted -> then tie up against volatility in NDX -> you know where that's going based on liquidity, inverted.

View attachment 6882View attachment 6883View attachment 6884View attachment 6885View attachment 6886

When you have all that figured out, for every $ position against debasement you take (essentially against Goverments) you’ll be able to hundreds to thousands without leverage by leveraging the risk curve in assets against greed in the market cycles, liquidity cycles and tightening cycles.

You therefore premptive know what assets, what entry zone and what exit zone.

And at that point 8,16,50% growth in a year becomes dull - and you only want that as residual store of value assets that are deflationary whilst your main allocation adds to it every cycle.

You can access them all online as they were open-sourced and put into a bigger system.Thank for sharing. I was wondering if you posted any recent charts?

https://tinyurl.com/4m4u7cye

Similar threads

- Replies

- 25

- Views

- 2,169

- Replies

- 22

- Views

- 1,086

- Replies

- 25

- Views

- 2,243

- Replies

- 32

- Views

- 3,191

Share:

Latest Threads

-

Best bank account for a Cyprus Ltd which is a consulting business?

- Started by A Rebours

- Replies: 7

-

Trusted List of service providers, exclusive for Mentor Group Gold members!

- Started by JohnLocke

- Replies: 3

-

-

-

Dubai Golden Visa Bank Deposit - Crypto

- Started by bwy

- Replies: 4