The (possible insider) hacker apparently did not know how to hide his traces and used his KYC'd account at Kraken, Kraken's chief security officer now says that they know who the hacker is and that FTX will be publishing an announcement soon.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

There is a rumour of FTX insolvency

- Thread starter troubled soul

- Start date

I do not like this guy at all...but sometime He make sense....

In world the lust for power and influence is more dangerous than Greed for money....

Breaking: SBF detained in Bahamas… The source familiar with the matter told Cointelegraph that the three former FTX executives, as well as Alameda Research CEO Caroline Ellison, are looking for ways to flee to Dubai, which "doesn't have any extradition treaties"…

Last edited:

https://www.levernews.com/washingtons-32-billion-crypto-scam/

Been listening to the Mario Na

Spending your money on influence is probably a better investment than a Bugatti and I think SBFs spending patterns have more to do with intelligence than some kind of inner greed.

Some people want to get rich and some want to build an actual empire. I think SBF & Co just got completed carried away and hell, even I thought two years ago looking at the market with the s**t that was going on that everyone was going to get away with it.

Then ever since the Luna crash it has been a constant spree of regulatory crackdown and Interpol newsflashes

The problem with crypto is people just can't help themselves, I think SBF was a fraudster from the get-go, but in a detached sense. He thought of this as a game and fair game in the wild-west and only soon reality will set in.

He saw an opportunity to get wealthy beyond his wildest dreams, and what might have started with using customer funds to generate returns, take the ROI and then returning the customer funds in a Milken way, went horribly wrong due to the chaotic and unpredictable nature of markets.

I am portraying him a bit too naive now though, I still think he is a cold-blooded sociopath who did everything in his power to make money at the expense of others, but he probably truly believed that money was better of with him than the "suckers" who traded against him (his clients).

Once you make a few missteps, you can do some good trades and moves to make the money back, but what happened here was likely that money was funneled off from the get-go so you already start a few % down, eventually everything drained into the abyss in a classic death spiral of overconfidence and stims.

Been listening to the Mario Na

Well, it seems more as if Tate is talking about luxury, which is different from money. And when it comes down to it this guy still lived in a $400m compound and had his own private jet.

I do not like this guy at all...but sometime He make sense....

In world the lust for power and influence is more dangerous than Greed for money....

Breaking: SBF detained in Bahamas… The source familiar with the matter told Cointelegraph that the three former FTX executives, as well as Alameda Research CEO Caroline Ellison, are looking for ways to flee to Dubai, which "doesn't have any extradition treaties"…

Spending your money on influence is probably a better investment than a Bugatti and I think SBFs spending patterns have more to do with intelligence than some kind of inner greed.

Some people want to get rich and some want to build an actual empire. I think SBF & Co just got completed carried away and hell, even I thought two years ago looking at the market with the s**t that was going on that everyone was going to get away with it.

Then ever since the Luna crash it has been a constant spree of regulatory crackdown and Interpol newsflashes

The problem with crypto is people just can't help themselves, I think SBF was a fraudster from the get-go, but in a detached sense. He thought of this as a game and fair game in the wild-west and only soon reality will set in.

He saw an opportunity to get wealthy beyond his wildest dreams, and what might have started with using customer funds to generate returns, take the ROI and then returning the customer funds in a Milken way, went horribly wrong due to the chaotic and unpredictable nature of markets.

I am portraying him a bit too naive now though, I still think he is a cold-blooded sociopath who did everything in his power to make money at the expense of others, but he probably truly believed that money was better of with him than the "suckers" who traded against him (his clients).

Once you make a few missteps, you can do some good trades and moves to make the money back, but what happened here was likely that money was funneled off from the get-go so you already start a few % down, eventually everything drained into the abyss in a classic death spiral of overconfidence and stims.

Last edited:

Bad idea of them coming to Dubai, Ftx was quite popular there resulting in many affected people and one or the other affected person will not like that.

I do not like this guy at all...but sometime He make sense....

In world the lust for power and influence is more dangerous than Greed for money....

Breaking: SBF detained in Bahamas… The source familiar with the matter told Cointelegraph that the three former FTX executives, as well as Alameda Research CEO Caroline Ellison, are looking for ways to flee to Dubai, which "doesn't have any extradition treaties"…

They should go to where ftx was a true non-event.

To the Russian-Ukrainian front line?They should go to where ftx was a true non-event.

Non-english speaking europe, africa etc. etc.To the Russian-Ukrainian front line?

That video is nonsense though, the guy was living it big time in the Bahamas. The frugal man driving a Corolla was an act.

I do not like this guy at all...but sometime He make sense....

In world the lust for power and influence is more dangerous than Greed for money....

Breaking: SBF detained in Bahamas… The source familiar with the matter told Cointelegraph that the three former FTX executives, as well as Alameda Research CEO Caroline Ellison, are looking for ways to flee to Dubai, which "doesn't have any extradition treaties"…

And obviously this guy's special powers for 'not trusting guys like SBF' only arrived after the fact, because he was promoting FTX to his paid group prior to it bombing. So I'm sure if you join his HU, you'll definitely escape the matrix.

Yah, correct. He is one month late at best.That video is nonsense though, the guy was living it big time in the Bahamas. The frugal man driving a Corolla was an act.

And obviously this guy's special powers for 'not trusting guys like SBF' only arrived after the fact, because he was promoting FTX to his paid group prior to it bombing. So I'm sure if you join his HU, you'll definitely escape the matrix.

that guy is an actor first and foremost and media personality. Just he plays "the villain". But hes a quite a good one.

Yeah, Tate is funny and I like the things he's put out, that takedown of Meghan and Harry interview was gold, he does a good job of taking other people's ideas and articulating them in his style.Yah, correct. He is one month late at best.

that guy is an actor first and foremost and media personality. Just he plays "the villain". But hes a quite a good

I would like him more if his success was from genuine business though, and not just charging idiots $49 a month to be "taught how to make money by verified millionaires". I get it's a zero-sum game, and that money would be going to another course etc so he may as well position himself there to take a share of it, but still, I'd take him more seriously if he had verifiable results in another business endeavour.

Yah spot on. He is a skilled influencer. For self-(brand)-marketing, I'd get his business advice.Yeah, Tate is funny and I like the things he's put out, that takedown of Meghan and Harry interview was gold, he does a good job of taking other people's ideas and articulating them in his style.

I would like him more if his success was from genuine business though, and not just charging idiots $49 a month to be "taught how to make money by verified millionaires". I get it's a zero-sum game, and that money would be going to another course etc so he may as well position himself there to take a share of it, but still, I'd take him more seriously if he had verifiable results in another business endeavour.

I think you and I can agree that BTC existed before USDT and that it will exist thereafter, just at $100 a coin or less.Lol dude, again, you just pull some stuff out without providing any basis/links or any other doc.

Learn about Bitcoin first, then talk.

Bitcoin existed before Tether and will exist thereafter.

You do not seem to understand the correlation between that the blockchain is foulproof indeed, but the actors behind it arent. IF the wealth of Crypto is in the hands of the few, these few control the market. That is why is centrally decentralised. Noone can take away your precious bitcoin tokens, but it can sure as hell tank when s**t hits the fan as you seen just now.

Binance seems to be on a warpath for domination , which they should as its business, not altruism. You seemingly like to stick your hand in the sand and worship at the altar of Bitcoin like a brainwashed stockholm syndrome survivor.

I will stop responding here, but as long as you make sure not all your wealth is in crypto, thats all you need to do.

Be condemned or does he say bitconneccttttt......

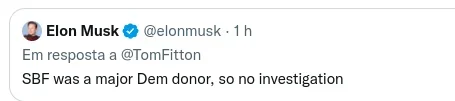

More reports that FTX laundered money that USA sent to aid Ukraine and they sent back to democrat party via FTX

Reports that crypto.com is being investigated (pls withdraw funds asap)

Weird stuff going on involving Bill Ackman:

https://www.marketwatch.com/story/i...ankman-fried-in-now-deleted-tweet-11668188684

money laundering 101

Reports that crypto.com is being investigated (pls withdraw funds asap)

Weird stuff going on involving Bill Ackman:

https://www.marketwatch.com/story/i...ankman-fried-in-now-deleted-tweet-11668188684

money laundering 101

Attachments

Last edited:

Again, provide some arguments underlined with facts and some articles for example, not what you think it is true out of your moms basement.I think you and I can agree that BTC existed before USDT and that it will exist thereafter, just at $100 a coin or less.

You do not seem to understand the correlation between that the blockchain is foulproof indeed, but the actors behind it arent. IF the wealth of Crypto is in the hands of the few, these few control the market. That is why is centrally decentralised. Noone can take away your precious bitcoin tokens, but it can sure as hell tank when **** hits the fan as you seen just now.

Binance seems to be on a warpath for domination , which they should as its business, not altruism. You seemingly like to stick your hand in the sand and worship at the altar of Bitcoin like a brainwashed stockholm syndrome survivor.

I will stop responding here, but as long as you make sure not all your wealth is in crypto, thats all you need to do.

Be condemned or does he say bitconneccttttt......

Still any doubt it was all planned to receive support for regulations ?

If you ever listened to her you would know how dumb she is and would never ever got such a position if there was no purpose behind it

This aged wonderfully well.Nah, it's a narrative we are pushing to crush SBF...

Technically they are ok, but then again its a house of cards propped up by FTT... so its risk level is higher than standard....

But nuts and bolts its an agenda to punish him for trying to buy politicians and get state protection for FTX at the cost of competition (Centralised and Decentralised).

SUre, of course, whatever you say.FTT token is under pressure but the market cap is pretty small and I think they could just buy it all if they want to support the price. SBF said in June that they have a few billion on hand to support projects.

Alameda Research is reported to have $billions of FTT already, which is also raising eyebrows. If they only have $7 billion of debt, then I guess they're still in an OK position.

I don't hear people questioning FTX exchange's solvency. I would be surprised if they do not have a ton of cash and assets.

If FTT price does drop a lot before FTX/Alameda support it, then it would be a good time to stock up for trading discounts. I really wish I hadn't sold my BNB in 2017...

PS: This aged well.

It's called the Stockholm syndrome. Rebranded as the 'crypto moron illusion' syndrome. I'm now browsing thoroughly through this thread as it'll give a good indication of how many crypto morons, pardon me, shills, eh, pardon me again, enthusiasts, there are...I still remember when someone tried to warn people about the impending bankruptcy of Celsius and the all people ridiculed him for it. A week later and Celsius halted withdrawals. I truly hope this will be different. In any case, be careful out there

NVO

This is the CumLord award for crypto-shiller of the year. Either you're full of it or believe the crap you say, but either way, there's a beachside house in Paris I'd like to sell to you. And an intern position at Sequoia, while we're at it, too. The state of these people......FTT securitises 33% of FTX fees (among other things), so a small market cap would be a positive sign because (income / market cap) increases. More on that at the end.

FTT is propped up by Alamada (who bought lots) and FTX (who buy it weekly and burn it). I don't see how FTT props up FTX; the token provides holders with discounts.

I do agree that people want to punish SBF for trying to buy politicians and get state protection for FTX. I believe that he is sincere in wanting the US to provide a better legal framework, but this will inevitably include a level of regulation that many crypto enthusiasts will hate.

If we discount FTT to zero (which I wouldn't at this time) then Alameda's assets would still be more than liabilities. However, they are exposed to SOL and other crypto.

Yes it's the coindesk article with some added commentary but also a link to this FTX page on FTT which helps explain the model.

At the start of this month, FTT was trading at $26.10. With a $2.8 million buy back and burn per week, that represent 4.2% annual yield on circulating supply.

As I write this, FTT is trading at $15.78. With a $2.8 million buy back and burn per week, that would represent 6.9% annual yield.

The fundamental value (FTX burning about $2.8 million per week) remains, but you can get 65% more of it for your $100 than you could a week ago.

This is where Alameda's holding raises eyebrows, what if their total assets drop below $8 billion (i.e. SOL and other crypto drop as well as FTT)? There would be no benefit in forcing Alameda to sell on the open market, because the biggest market (FTT-USDT on Binance) has less than $4million in liquidity above $10. There is a large buy order for FTT on FTX, which could be a related party.

I am not saying that now is the right time to buy or that $15.78 is the right price (it could be a bargain, or not), but FTX is committed to buying a few million dollars of FTT per week so at some market cap it makes sense, if you believe that FTX will remain in business and generating exchange market fees.

smh.........

More llike a 'cow', me thinks, but hey, what do I know...The bull has arrived. A halt in trading is more likely before it goes to zero. But you may do well fingers crossed. No risk no gain.

I'd gladly take the other side of that bet. When CCP runs out of funds to support this scam. And I'll come back to mock you, no doubt about it.yah we all know the tether fud which I have heard a 1000x by now since 2017. And here we are, tether still at 1$ at time of this post.

Sh*t always appears when there is an abundance of money supply...most of these idiot$ have never seem real life or proper market cycles, hence the extremely childish, delusional narrative. And yet, billions poured in by 'sophisticated' investors. They all deserve what's coming to them, fak yeah.Correct. And others will follow. This teenager industry was destined to fail.

Ahh, those CCP operatives, alive and well...always happy to learn the disabled, lol...and you believing the crypto space was not legit, FUDers!Crypto exchange Binance helped Iranian firms trade $8 billion despite sanctions

https://www.reuters.com/business/fi...ian-firms-trade-8-billion-despite-2022-11-04/

We do need an inverse Jim sucker Cramer ETF now!LOL, It is pretty obvious......Timing of hack say it all...The timing is way too convenient.....This guy claiming that He did not care about money....he want to donate his all money....now see How greedy he really is !!!!

Such a low life human !!!!!! May NSA having logged all of #FTX's & Alameda Research's blockchain transactions from day one.

View attachment 4221

What a time we live in !!!

Can any Bahamas resident put some light on what happening at their HQ in Bahamas ?

BTW

Make sure you enjoy your weekend. Life is short. Money ain’t everything. Go have a good time

Last edited:

@Nicholas Van Orton I wrote that I would be surprised if Alameda lacked assets (in addition to FTT). I was surprised, very. One day we'll see what happened. Bad project investments? Exit scam? Horrendously bad market making? Losing billions as FTX's primary backstop liquidity provider seems to be a popular theory.

I also wrote that FTT should have some value, "if you believe that FTX will remain in business and generating exchange market fees". If FTX had remained in business and generating fees then I would still believe that FTT had "some" value, due to 1/3 of fees in buy and burn.

FTX did not remain in business and is not generating fees. On these facts I don't see how even the current $1.50 is justified. Half a billion market cap today on a token that lost its reasons to exist. Millions of dollars of bids in Binance's orderbook.

I also wrote that FTT should have some value, "if you believe that FTX will remain in business and generating exchange market fees". If FTX had remained in business and generating fees then I would still believe that FTT had "some" value, due to 1/3 of fees in buy and burn.

FTX did not remain in business and is not generating fees. On these facts I don't see how even the current $1.50 is justified. Half a billion market cap today on a token that lost its reasons to exist. Millions of dollars of bids in Binance's orderbook.

@remindmeofthis in 2 years...smhyou have obviously not studied bitcoin, not even for some hours.

Also regarding tether, you cannot just come up with accusations without providing any proof.

You can read this and then attack that article for example, just to add some facts and context.

https://u.today/crypto-veterans-praise-usdt-highly-amid-market-drama-why

The only (sad for them) trth. And I, unfortunately, can see many of them here. Chairs are disappearing fast, folks.Believers = Bagholders

Fiat, at least to the common mortal, lets him buy his daily bread, as its operational. BTC on the other hand like gold, is an asset...if you shillers would just trat it as what it is, another speculative asset that may go up or down in value, and stopped the cult-like rhetoric, I'd frankly like to engage in a conversation with you...else, I'll pass.Fiat itself is also not stable, this year proofs this.

In your example, maybe you have made 20% overnight? It works both ways

OK, I couldn't care less it its value drops to -50, to be honest. Scammers be scammers and run scams, you know. And all have a certain common ground in their names. BTW, check FTX's general counsel Dan Friedberg (another usual ringtone name in these cases), and do a google search "poker scandal". So that's the level of what you shills are attempting to defend. Period.@Nicholas Van Orton I wrote that I would be surprised if Alameda lacked assets (in addition to FTT). I was surprised, very. One day we'll see what happened. Bad project investments? Exit scam? Horrendously bad market making? Losing billions as FTX's primary backstop liquidity provider seems to be a popular theory.

I also wrote that FTT should have some value, "if you believe that FTX will remain in business and generating exchange market fees". If FTX had remained in business and generating fees then I would still believe that FTT had "some" value, due to 1/3 of fees in buy and burn.

FTX did not remain in business and is not generating fees. On these facts I don't see how even the current $1.50 is justified. Half a billion market cap today on a token that lost its reasons to exist. Millions of dollars of bids in Binance's orderbook.

NVO

Probably the best answer on the whole thread. And yet, @JackAlabama shill will continue peddling the cult rhetoric, I'm afraid. I won't take part in it, though, sound like a broken record already.I think you and I can agree that BTC existed before USDT and that it will exist thereafter, just at $100 a coin or less.

You do not seem to understand the correlation between that the blockchain is foulproof indeed, but the actors behind it arent. IF the wealth of Crypto is in the hands of the few, these few control the market. That is why is centrally decentralised. Noone can take away your precious bitcoin tokens, but it can sure as hell tank when **** hits the fan as you seen just now.

Binance seems to be on a warpath for domination , which they should as its business, not altruism. You seemingly like to stick your hand in the sand and worship at the altar of Bitcoin like a brainwashed stockholm syndrome survivor.

I will stop responding here, but as long as you make sure not all your wealth is in crypto, thats all you need to do.

Be condemned or does he say bitconneccttttt......

Last edited:

As much as $2 billion in FTX customers' funds has reportedly vanished from the collapsed crypto exchange

https://markets.businessinsider.com...ing-collapse-bankruptcy-bankman-fried-2022-11

---- quote start

Last week, Bankman-Fried shared documents with other FTX executives that showed the missing funds, Reuters reported. The materials revealed a "back door" into the company's books built using bespoke software.

The sources said the "backdoor" allowed Bankman Fried to alter the company's financial records without alerting other people. That meant the transfer of $10 billion did not set off any alarms, they said.

---- quote end

Similar threads

- Replies

- 6

- Views

- 389

- Article

- Replies

- 21

- Views

- 2,712

- Replies

- 9

- Views

- 2,535

- Replies

- 15

- Views

- 1,963

Share:

Latest Threads

-

How to Open a Bank Account in Mexico for Residents & Non-Residents

- Started by Kim-OTC

- Replies: 0

-

How Do You Open a Bank Account? Requirements, Considerations & Precautions

- Started by Kim-OTC

- Replies: 0

-

-

Compte Offshore En Ligne & Other Forms of Offshore Bank Accounts Explained

- Started by Kim-OTC

- Replies: 0

-

Can anyone help me with processing credit cards to get Crypto?

- Started by Moskva777

- Replies: 0