IB use custodian banks but even if IB acts custodian, your assets are separated/recoverable in case of IB bankruptcy but ensure that you have a cash account not margin etc.. The most significant risk is insider fraud but it is unlikely because IB is a public company. They're audited more and strictly and everyone can access their financials.This is valid for institutional investor,

I’m an individual investor. I read somewhere that for individual investors IB acts as the depositor/custodian which means the risk stays with IB.

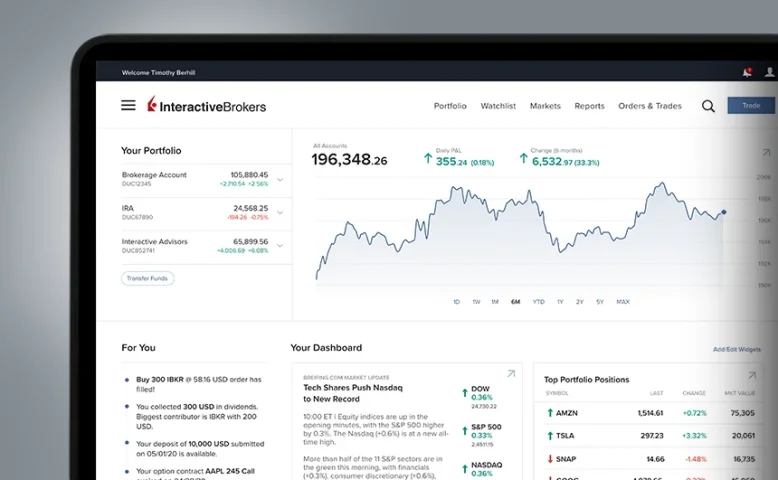

https://www.interactivebrokers.com/en/index.php?f=2334

Another option is Saxo Bank. They use Citibank as custodian. If Saxo bank fails, you should able to recover your funds from Citibank. If Citibank fails, you should be able to recover your funds because custodian accounts are not assets of bank/financial institutions. This means creditors cannot access to custodian accounts. Custodian accounts are segregated. The downside of Saxo Bank is they're not a public company and smaller than both IB and SQ.

You can also go with tier 1 banks like Citibank IPB, HSBC, BNP Paribas but expect 0.50% custodian fee + 1% transaction fee but still not guarantees that your assets will hold with the bank. Even banks use different custodian banks depends on asset origin, market, currency etc...