So, in the event of war, Bitcoin and Ethereum are more secure according to what you're writing? I would like to have that explained a bit more.

Bitcoin runs on a satellite network as a backup, with various incorporated mesh networks.

For example, in my home office, i have a tv satellite dish

Blockstream Satellite: Bitcoin blockchain broadcasts with some additional standard hardware and some software which is used to connect provide a redundancy for the bitcoin network, it's not completely 100% redundancy protection but suspect in the event say the cables from the East and the West being severed that there is a slim likely hood that the chain would split due to not being connected world wide.

Where ETH is concerned I am unsure of any exercises for this as it stands...

What is needed (small 60k-100k satellites for repeaters being sent up with SpaceX).

---

Where PAXG is concerned just checked our corporate treasury, we had 100k as understood, now 125k.

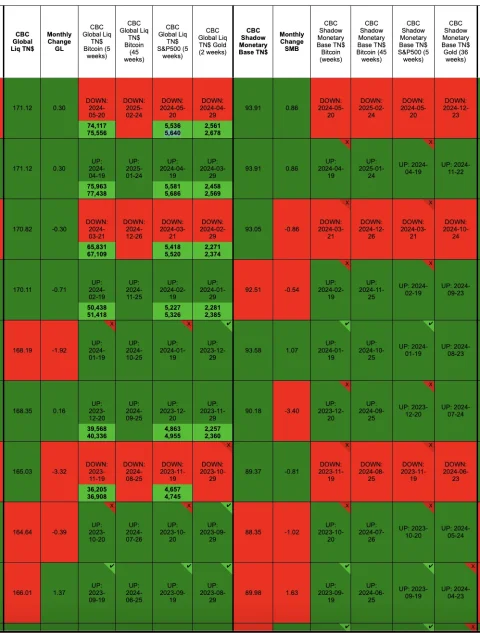

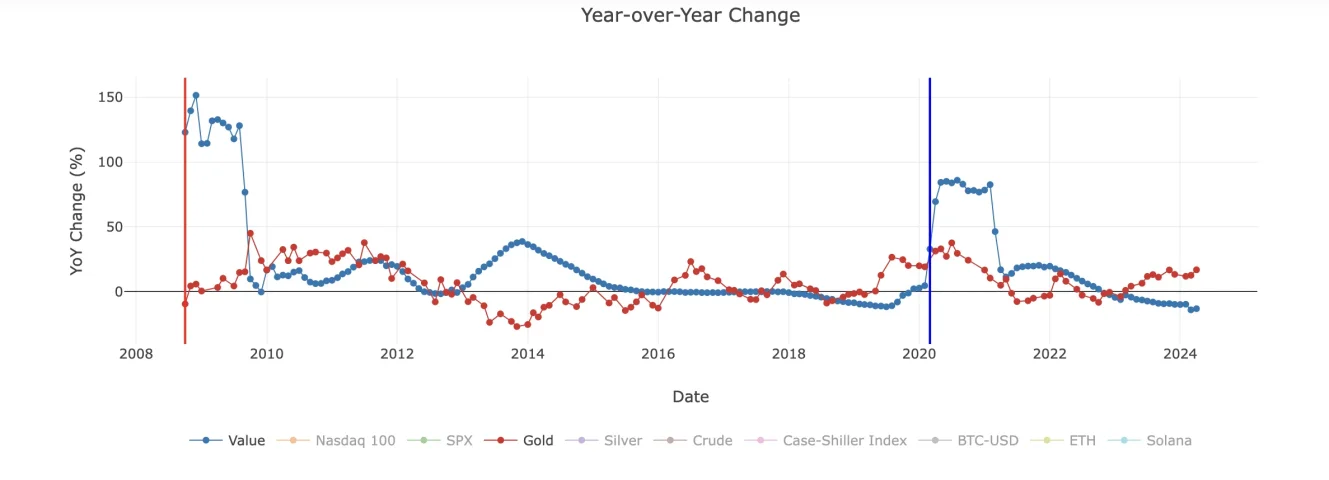

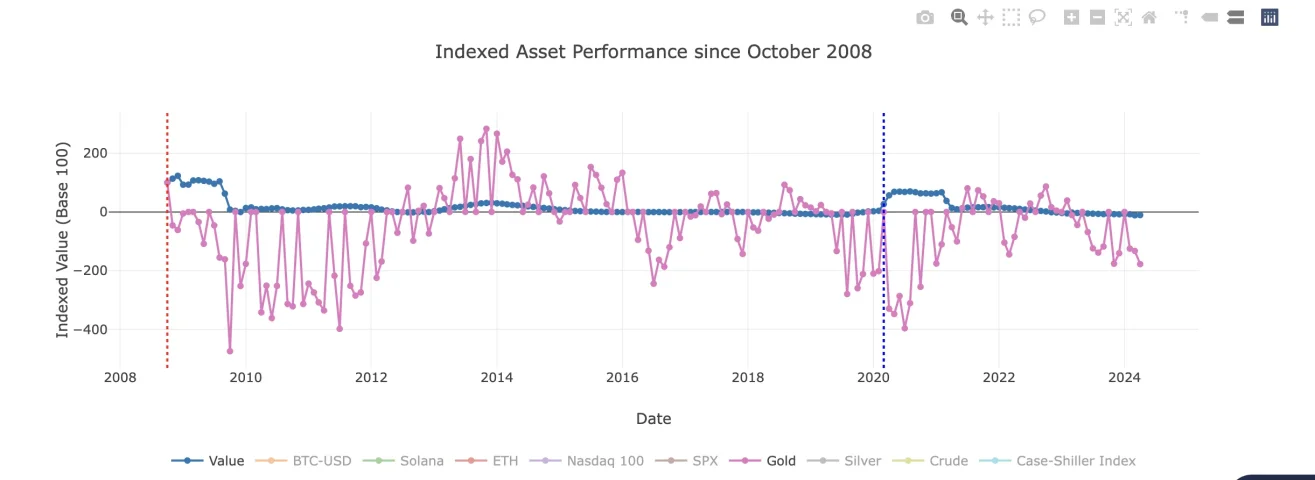

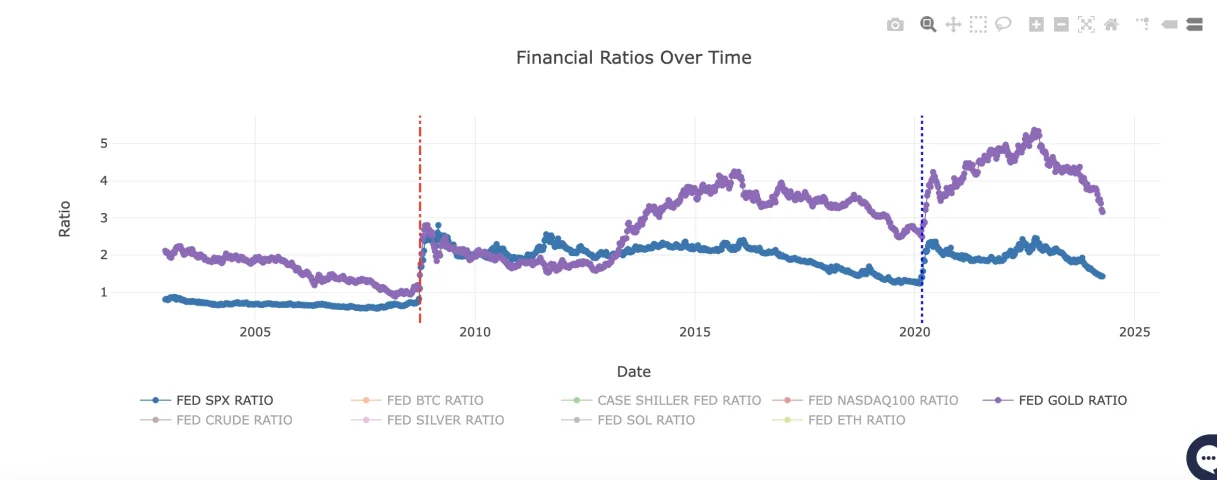

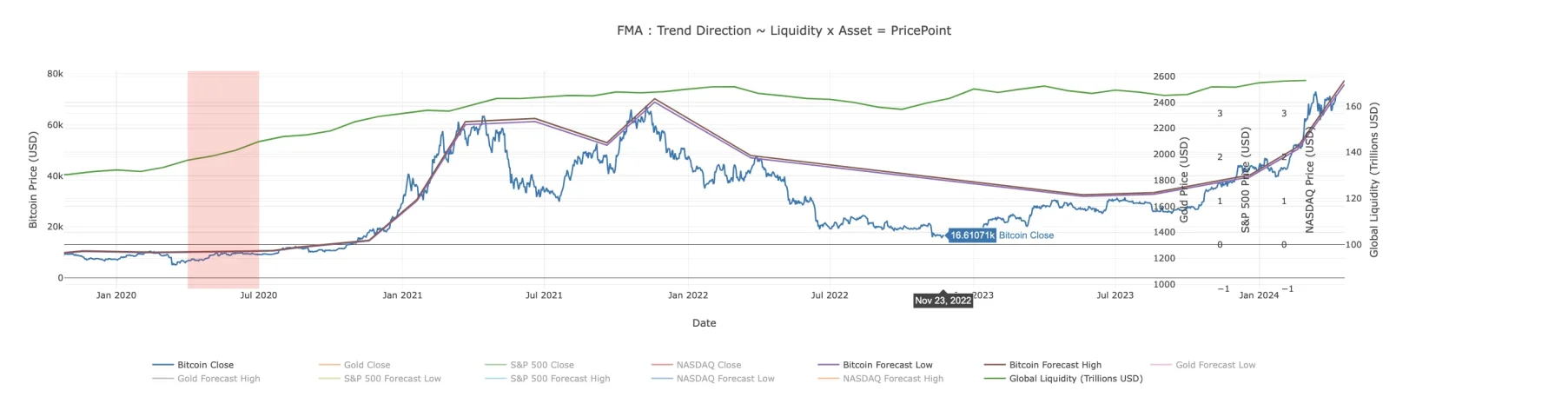

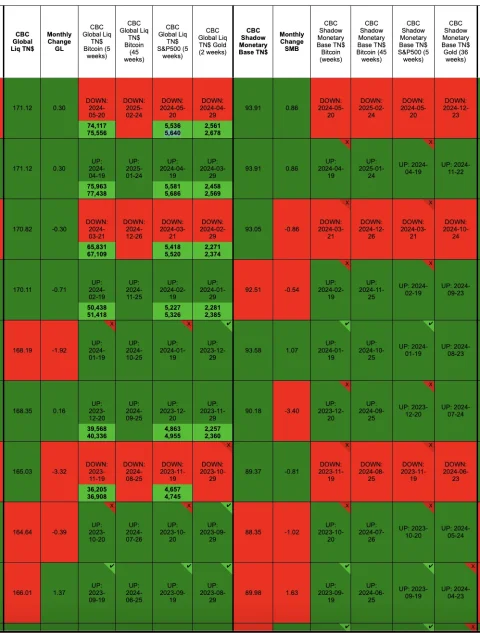

During the period from 2020.

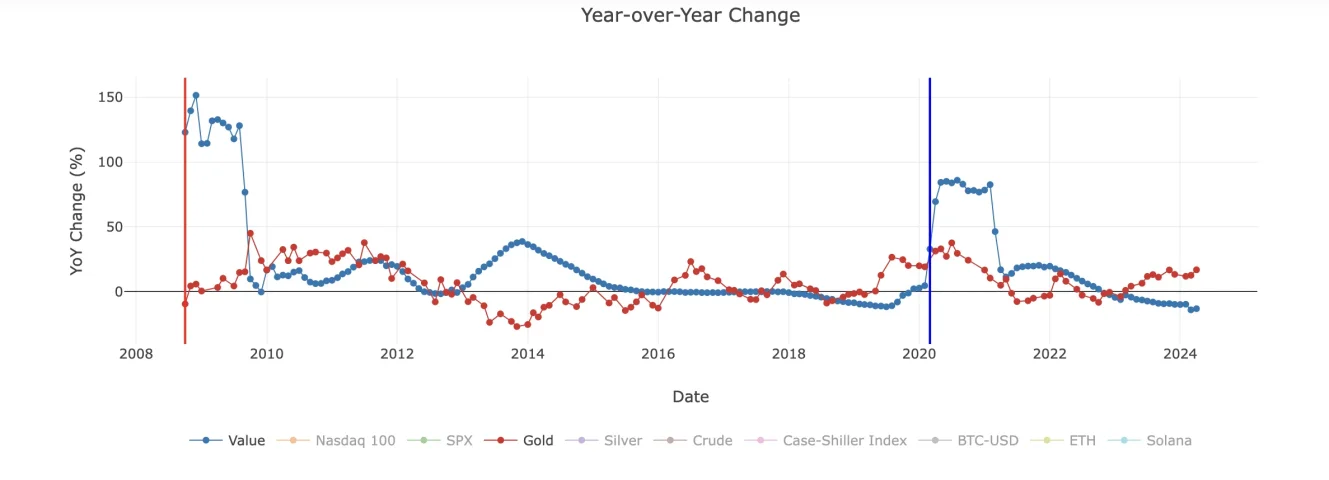

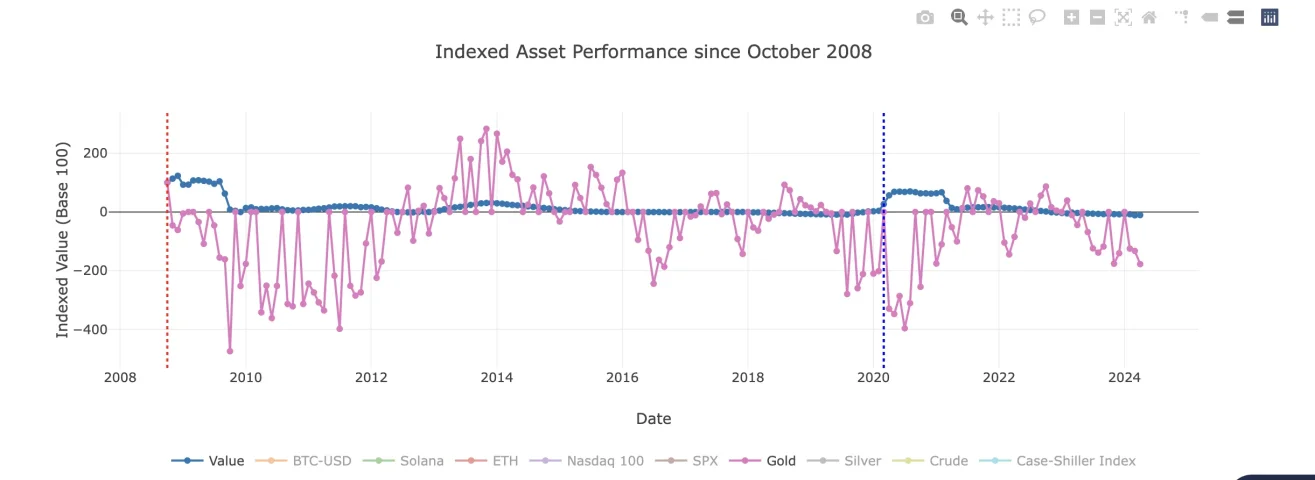

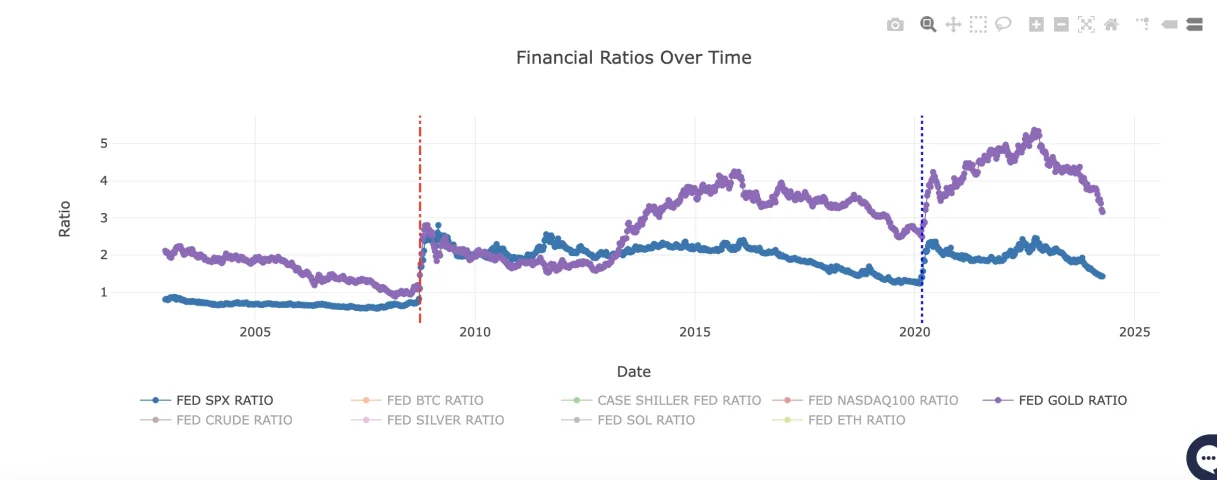

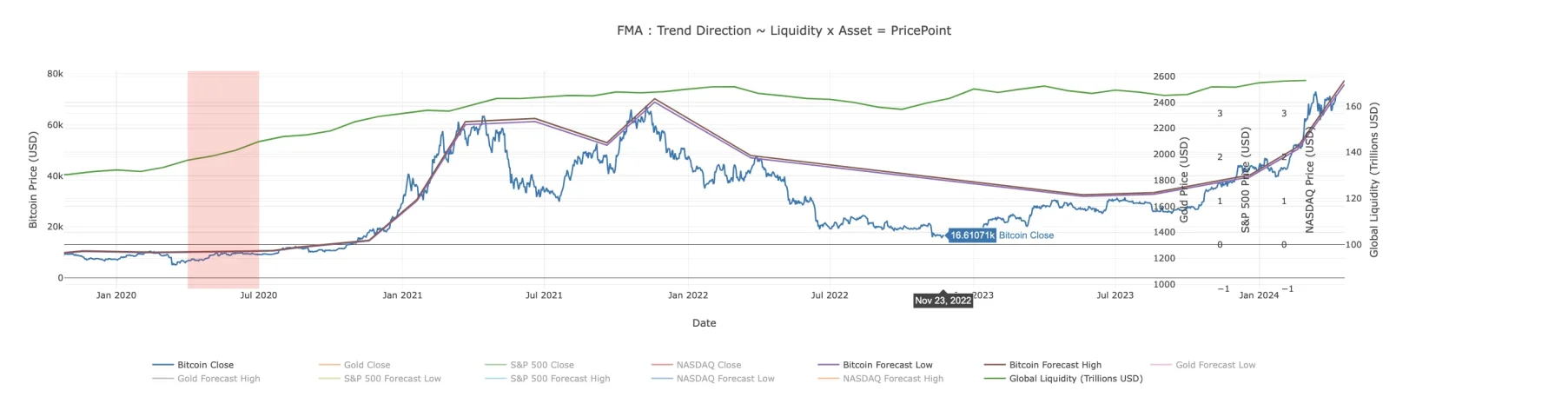

Currency debasement (except 2022-2023) has been on average 13-15% pa (most people don't see this as it's basically locking up bonds on balances sheets which means they don't enter the real economy directly but they do seep into the markets, and appreciate asset prices (hence wealthy get wealthier, poor get poorer).

And inflation is 27% aggregated through that period.

so 100,000$ (off the cuff/napkin) - 27% - 39% (2020-2021-2022,2023-2024) = 66% decline in true spending power + 25% nominal value = 91% so on average = 3% so the tightening (strengthening of the $) during the rate hike and then liquidity flow period has recovered 1% per annum in spending power loss, whereas from 2013-2020 Gold historically has lost 4% PA against combined debasement & inflation.

Gold proceeds to rise roughly 13-15% against liq increases per 10%, bitcoin roughly 90%, down the risk curve more growth achievable in ETH/SOL.

Gold proceeds to rise roughly 13-15% against liq increases per 10%, bitcoin roughly 90%, down the risk curve more growth achievable in ETH/SOL.

But holding gold is like holding a melting ice-cube standing inside a fridge, its still melting, it's a s**t debasement hedge, but perhaps its hedge as in it's physical and not reliant on coms lines.

Holding cash is like holding a melting ice cube standing in Cairo at lunch time.