You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Euro Pacific bank is a scam

- Thread starter sonato

- Start date

-

- Tags

- euro pacific bank

To kill the banking business that was at least in part helping finance this bankrupt banana land?easy very simple they are regulated in AAA jurisdiction already so thats the reason why they get that licence.

Back in the days when EPB applied you needed 500,000 USD regulatory capital now you need 10,000,000 USD.

Wonder why?

Sorry but who in their right mind is gonna put capital higher than several EU & tier 1 jurisdictions and all the other offshore banking countries into a US territory that was stuck in bankruptcy just a few years ago and is hardly recovering?

For what benefit? To maybe clear USD on your own in 3-5 years if the NY Fed feels very very kind?

exactly, it was a political decision to increase the hurdles so high from OCIF and the current government.

There were too many scandals and non-compliance like EPB and others.

Even the annual fees of 25,000 USD are crazy.

https://www.mcvpr.com/newsroom-publications-IBE-IFE-Reform

There were too many scandals and non-compliance like EPB and others.

Even the annual fees of 25,000 USD are crazy.

https://www.mcvpr.com/newsroom-publications-IBE-IFE-Reform

For sure, but you should not throw the baby out with the bathwater.exactly, it was a political decision to increase the hurdles so high from OCIF and the current government.

It's like buying 50 apples, finding 1 ugly apple, and throwing the other 49 out without taking a single look at them. Sure, you protect yourself from having to try 49 other apples that could be good or bad, but you also stay hungry

But do we really know that EPB did something wrong?There were too many scandals and non-compliance like EPB and others.

I mean there are accusations of insolvency but if we take @Pschiff statements at face value, the bank was not lending and its capital was (and still seems to be for now) enough to pay out the depositors without much trouble. Novo was a hold up but the funds were not lost.

And there also does not exist legal evidence that EPB was laundering or only holding accounts for tax evaders. I don't want to play devil's advocate; on the other hand, one is always innocent until proven guilty.

This is true, but I think we all already knew PR is quite a joke jurisdiction.Even the annual fees of 25,000 USD are crazy.

https://www.mcvpr.com/newsroom-publications-IBE-IFE-Reform

Its only selling point was the low capital and decently simple past compliance. Now it is almost worthless for international banking except for the few institutions that have accounts at the Fed or BoA/JPM.

1) EPB tapped regulatory capital (evidence in OCIF resolution)

2) Qenta was not-fit-and proper (look at 9fraud.com a site from PS apparently) where OCIF wrote to PS lawyers that Qenta was not disclosing needed information and tried to hide business dealings in Bosnia Herzegovina (FATF grey listed) and Syria (FATF black listed)

2) Qenta was not-fit-and proper (look at 9fraud.com a site from PS apparently) where OCIF wrote to PS lawyers that Qenta was not disclosing needed information and tried to hide business dealings in Bosnia Herzegovina (FATF grey listed) and Syria (FATF black listed)

Last edited:

If 2) is true i think it is impossible that receiver would go ahead and transfer the deposits to Qenta. OCIF has to give her go ahead for the plan, and that she would never do if 2) is correct1) EPB tapped regulatory capital (evidence in OCIF resolution)

2) Qenta was not-fit-and proper (look at 9fraud.com a site from PS apparently) where OCIF wrote to PS lawyers that Qenta was not disclosing needed information and tried to hide business dealings in Bosnia Herzegovina (FATF grey listed) and Syria (FATF black listed)

If 2) is true i think it is impossible that receiver would go ahead and transfer the deposits to Qenta. OCIF has to give her go ahead for the plan, and that she would never do if 2) is correct

Not fit and proper to own a bank in Puerto Rico.

I don't know the rules or discretion receiver has when it comes to where assets can/cannot flow to during liquidation. Criteria maybe lower.

yes the criteria for asset deals are lower. I am just surprised that OCIF agreed to that despite the fact that Qenta has no proper licence...

I am just surprised that OCIF agreed to that despite the fact that Qenta has no proper licence...

Well it was actually clients that agreed and not anyone else. There was an option to simply opt out of not using Qenta and have funds returned to a bank of their choice. Some clients decided they wanted their assets to flow to Qenta - rightly or wrongly so its on them.

So basically clients chose the Qenta option and assumed all downstream risks. i.e if my account was being closed and I asked my money to be sent to my account at Bank of Haiti its on me and not receiver what happens after a successful wire transfer.

I am just confused as to why Peter said some opt-out assets went to Qenta.

The opt-in clients including me have chosen Qenta voluntarily, what was my second biggest mistake after opening account with EPB, if Qenta has wasted our funds or part of them.

PS knows the truth, if he wants tell that to us.

In case he will be silent, it is already an answer.

PS knows the truth, if he wants tell that to us.

In case he will be silent, it is already an answer.

Last edited:

Notice how Peter Schiff now vanished! He probably will not return to this forum!

Why? The Qenta disaster, that we will hear much more about in 2025, is now being exposed! Something Peter was the mastermind behind (and it wasn’t to help customers)! He has told some customers that he thinks Qenta spent the money!

Peter has made endless wrong statements (“Qenta was a highly qualified buyer”) but disappears when his usual sales pitch / broken record is challenged by smart people!

People will lose money because Peter couldn’t follow the banking rule (FACT 1) and because Qenta spent them as those funds weren’t segregated (FACT 2)

Opt-in customers are in the worst position!

Why? The Qenta disaster, that we will hear much more about in 2025, is now being exposed! Something Peter was the mastermind behind (and it wasn’t to help customers)! He has told some customers that he thinks Qenta spent the money!

Peter has made endless wrong statements (“Qenta was a highly qualified buyer”) but disappears when his usual sales pitch / broken record is challenged by smart people!

People will lose money because Peter couldn’t follow the banking rule (FACT 1) and because Qenta spent them as those funds weren’t segregated (FACT 2)

Opt-in customers are in the worst position!

I seriously dont’ understand how the reciever and ocif can accept that the funds are not segregated.Notice how Peter Schiff now vanished! He probably will not return to this forum!

Why? The Qenta disaster, that we will hear much more about in 2025, is now being exposed! Something Peter was the mastermind behind (and it wasn’t to help customers)! He has told some customers that he thinks Qenta spent the money!

Peter has made endless wrong statements (“Qenta was a highly qualified buyer”) but disappears when his usual sales pitch / broken record is challenged by smart people!

People will lose money because Peter couldn’t follow the banking rule (FACT 1) and because Qenta spent them as those funds weren’t segregated (FACT 2)

Opt-in customers are in the worst position!

Is this confirmed?

how can a receiver agree to give the funds to Qenta when OCIF does not aprove QentaThe opt-in clients including me have chosen Qenta voluntarily, what was my second biggest mistake after opening account with EPB, if Qenta has wasted our funds or part of them.

PS knows the truth, if he wants tell that to us.

In case he will be silent, it is already an answer.

FACT 1: Deposit base USD 66.7mll on the day of the C&D Order (30th June 2022)

FACT 2: Total customers: 3,595 of which 1,702 “opt-in (47%) - & 1,893 customers “opt-out” (53%) - https://epbprliquidation.com/wp-content/uploads/09-15-2023_EPIB_Trustee_Case_Progress_Report.pdf:

FACT 3: Latest figure: Receiver is controlling USD 47.7 mll : https://epbprliquidation.com/wp-con...Receiver-Report-on-Work-Performed-Q3-2024.pdf

That means a BIG part was with Qenta!: Some USD 20mll is with Qenta! And they could be the entire money for opt-ins IF they are smaller depositors on average than opt-outs, which is a reasonable assumption given I knew several multi-million depositors who are opt-out!

FACT 2: Total customers: 3,595 of which 1,702 “opt-in (47%) - & 1,893 customers “opt-out” (53%) - https://epbprliquidation.com/wp-content/uploads/09-15-2023_EPIB_Trustee_Case_Progress_Report.pdf:

FACT 3: Latest figure: Receiver is controlling USD 47.7 mll : https://epbprliquidation.com/wp-con...Receiver-Report-on-Work-Performed-Q3-2024.pdf

That means a BIG part was with Qenta!: Some USD 20mll is with Qenta! And they could be the entire money for opt-ins IF they are smaller depositors on average than opt-outs, which is a reasonable assumption given I knew several multi-million depositors who are opt-out!

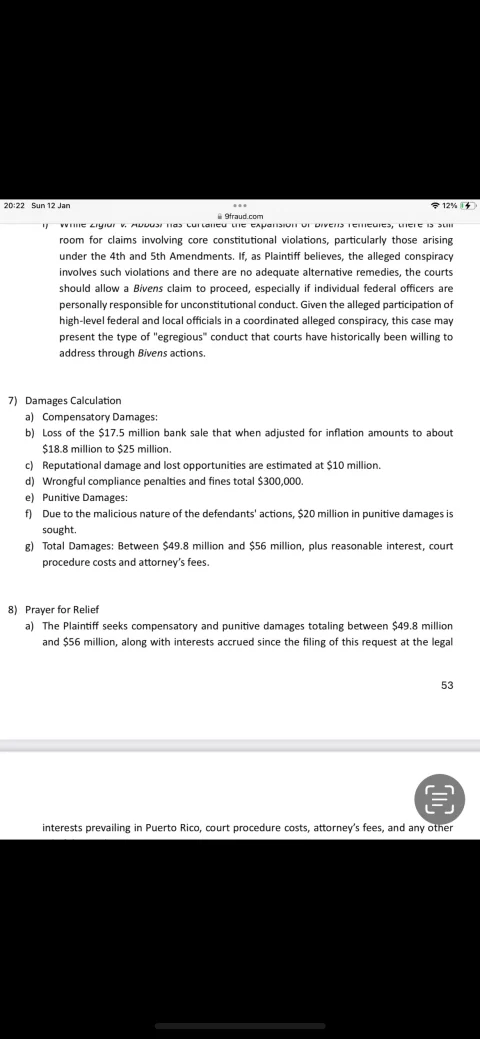

I can encourage everyone to read 9fraud.com it is very interesting and gives a good insight

into how EPB was run and how the major shareholder PS is thinking/working

into how EPB was run and how the major shareholder PS is thinking/working

The USD 20mll Qenta had & the 47 mll USD the receiver had = probably roughly the final allocation claim - even though the split is roughly equal beween opt-in/out in terms of number of actual clients :FACT 1: Deposit base USD 66.7mll on the day of the C&D Order (30th June 2022)

FACT 2: Total customers: 3,595 of which 1,702 “opt-in (47%) - & 1,893 customers “opt-out” (53%) - https://epbprliquidation.com/wp-content/uploads/09-15-2023_EPIB_Trustee_Case_Progress_Report.pdf:

FACT 3: Latest figure: Receiver is controlling USD 47.7 mll : https://epbprliquidation.com/wp-con...Receiver-Report-on-Work-Performed-Q3-2024.pdf

That means a BIG part was with Qenta!: Some USD 20mll is with Qenta! And they could be the entire money for opt-ins IF they are smaller depositors on average than opt-outs, which is a reasonable assumption given I knew several multi-million depositors who are opt-out!

A) all "non-responders" automatically became opt-ins and many here would have neglible deposits

B) I know several million USD depositors who are opt-out.

Hence the USD 20mll is probably the entire sum of Opt-ins. Sent to a financial start company (Qenta just had 3 year history) AND involved in speculative business (digital assets) and HIGHLY risky by its very nature - see for instance https://flabizlaw.org/member-articl...section-of-digital-assets-and-bankruptcy-law/ or https://www.isda.org/a/CrLgE/Naviga...ermediaries-and-Customer-Asset-Protection.pdf

But poor customers, many of them not having a financial background, were lured in...under the pretense of a QUICK payback and the false premise that Qenta was a "highly qualified buyer" as Schiff stated

Share:

Latest Threads

-

Looking for a country to make a high rentability real estate investment

- Started by flyingadventures662

- Replies: 0

-

Looking for advice on hosting for video streaming (HLS) – what’s the best approach?

- Started by Longvu

- Replies: 2

-

Facilitator for ultra low SEPA Instant Transfers needed

- Started by chrisgerth

- Replies: 0

-

-