Well said.

It's annoying to argue with people that mention all the time Bank Frick in Liechtenstein or Seba Bank in Switzerland as crypto friendly but don't have any clue.

Beside of the fact that the above Banks are charging amounts to cash out 7 or even 6 figure in crypto that are enough to setup 3 Dubai Companies with residence visa - the KYC is simply a joke.

Had personal conversation with both banks.

When I see our inquiries from people that are not comfortable paying 20€ for a SWIFT transfer with a UAE retail bank - well have fun with private banks in Switzerland and Liechtenstein that claim to be crypto friendly.

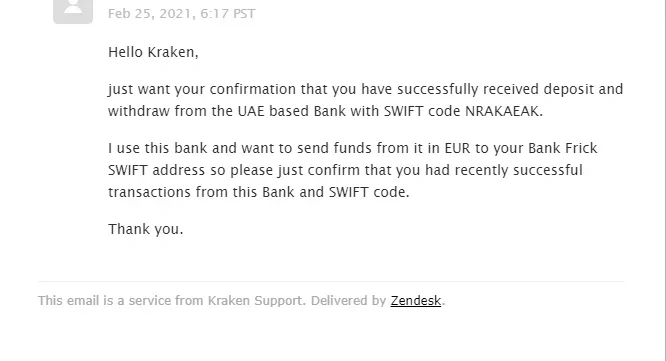

I agree with the mentioned from you regarding shady EMI's but this money never can be really used to gain wealth as no reputable private bank like UBS or Barclays will ever touch this funds. Even with the so called crypto friendly private bank Bank Frick many banks take a closer look and want to see if the money is coming from crypto. It's the same like back in the days when Mistertango obviously had no AML - banks started to simply consider Mistertango as a Crypto Exchange. Same is nowadays with Bank Frick they will be simply considered like another Kraken from Banks outside so it doesn't make a difference if the money comes from Kraken or Bank Frick.

Simply setup a Dubai Company with residence visa to setup local UAE retail bank accounts. Use some workaround that cover the cashout as business earnings and pay you a monthly salary. From this point on every bank is happy to inboard you as the source of funds is salary and the business earnings can be proofed easy if you know how it's working. Most of them are even located in the DIFC here in Dubai.

I mention Dubai because it perfectly fits for significant money to cashout. In a country with 0% tax and no accounting nobody will ask stupid questions if you pay 1m$ salary a month.

Make the same in Georgia and watch how your account get blocked.

Like mentioned here

Post in thread 'Best non CRS bank to cash out crypto THIS YEAR'

Best non CRS bank to cash out crypto THIS YEAR

Again I mention what I experienced in the praxis. If you have a good feeling with overpaying private banks in Liechtenstein and Switzerland of course go for it and let us know if you get through the KYC of them during the current bull market - most likely we are in the next bear market till they onboard you.

I even had a conversation with Falcon Private Bank in Dubai that mentioned to be crypto friendly and once I proceeded with the application they simply stopped there operations and were sold.