This is an actual thing in the US. It’s called prosecutorial discretion. The health insurance mandate is on the books but the penalty was repealed. Illegal immigration was never legal, just not prosecuted. It’s much easier to suspend enforcement than change a law or regulation.Well, Musk seemingly wanted to do it quickly, since it was cancelled less than 1 business day after he replied to a tweet requesting for it to be done.

I am not an expert on this area of law in general but it could be that Trump has the ability to remove the punishments with his decree while he couldn't do so to cancel the whole law, or maybe it was just simpler to arrange this way.

But yes, it seems like a bit strange of an approach

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BOI reporting for US LLCs (at least) temporarily suspended

- Thread starter Forester

- Start date

The law was passed by Congress, Congress has to remove it, Trump can only suspend enforcement or the courts can find it unconstitutional. Right now, no one can get in trouble for not complying as it would violate procedural due process in addition to the suspension.

The downside of relying on this discretion is it will buy you at most four years of being left alone, if Trump doesn’t change his mind. All it takes is a change in the administration. There are some illegal aliens who are literally being shipped to CECOT in El Salvador or Guantanamo Bay after thinking they’d be left alone after getting a catch-and-release citation from the border patrol four years ago.

The downside of relying on this discretion is it will buy you at most four years of being left alone, if Trump doesn’t change his mind. All it takes is a change in the administration. There are some illegal aliens who are literally being shipped to CECOT in El Salvador or Guantanamo Bay after thinking they’d be left alone after getting a catch-and-release citation from the border patrol four years ago.

US still is best jurisdiction for incorporation. Several states still do not require the names of officers and directors to be recorded. There is no identifcation requirement. And entities like non profits can be incorporated for as little as $25. Registered agent annual fees are usually well under $100 and include an official address. A holding company would have zero tax returns and if it has no EIN and no revenue, might get away as a non filer. There are entities like UNAs and trusts which are exempt from BOI and not required to file tax returns and disregarded entities like some LLCs. The BOI threw a wrench into some of that but is dead for now. Even if it is revived, one can just dissolve it, abandon it depending on jurisdiction or migrate it.

your name is recorded at the banking level and at the irs thru the ein and the reporting. Its by far anything from good and you can have similar setup elsewhere.US still is best jurisdiction for incorporation. Several states still do not require the names of officers and directors to be recorded. There is no identifcation requirement. And entities like non profits can be incorporated for as little as $25. Registered agent annual fees are usually well under $100 and include an official address. A holding company would have zero tax returns and if it has no EIN and no revenue, might get away as a non filer. There are entities like UNAs and trusts which are exempt from BOI and not required to file tax returns and disregarded entities like some LLCs. The BOI threw a wrench into some of that but is dead for now. Even if it is revived, one can just dissolve it, abandon it depending on jurisdiction or migrate it.

your name is recorded at the banking level and at the irs thru the ein and the reporting. Its by far anything from good and you can have similar setup elsewhere.

The EIN can be obtained by anyone with a SSN, it does not require a officer or director. Banking is another matter.

You can also get it without SSN.The EIN can be obtained by anyone with a SSN, it does not require a officer or director. Banking is another matter.

You can also get it without SSN.

The CTA was going to be a huge headache because many US companies that were just holding assets had never bothered to file a zero tax return or get a EIN. The IRS had no way of knowing the company existed unless it requested a EIN. In fact, many publicly listed OTC (Pink Sheet) companies never filed taxes either because they never made a profit and knew the IRS was not going to enforce on companies with no revenue or profits, since no real penalty was possible. The CTA created a crime and a penalty because the rest of the world complained that the US system was out of synch. Trump however did not buy into the globalist agenda.

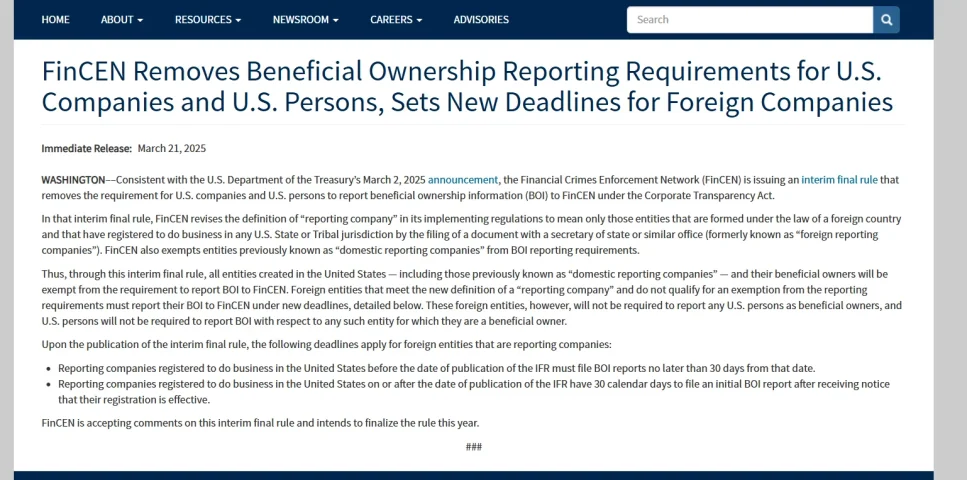

didn't read this but try if you got the time (and will power)... it's the interim rule. After a few pages I felt dazed and confused, I am not reading that s**t again, stupid convoluted US tax code

https://fincen.gov/sites/default/fi...notices/2025-03-21/CTAIFR3-21-25-FINAL508.pdf

https://fincen.gov/sites/default/fi...notices/2025-03-21/CTAIFR3-21-25-FINAL508.pdf

These:didn't read this but try if you got the time (and will power)... it's the interim rule. After a few pages I felt dazed and confused, I am not reading that s**t again, stupid convoluted US tax code

https://fincen.gov/sites/default/fi...notices/2025-03-21/CTAIFR3-21-25-FINAL508.pdf

This exemption is applies to “any entity that is: (A) a corporation, limited liability company, or other entity; and (B) created by the filing of a document with a secretary of state or any similar office under the law of a State or Indian tribe.”

“Reporting companies are exempt from the requirement in 31 U.S.C. 5336 and this section to report the beneficial ownership information of any U.S. persons who are beneficial owners.”

Share:

Latest Threads

-

-

-

-

-

Left the UK, in Dublin, might not move?

- Started by Eurocash

- Replies: 5