You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Total return by asset for last 200 years

- Thread starter uranium

- Start date

Stocks, eh?

But on the chart, there was no dip in stock valuation, 1929-1939 when the stock markets crashed all around the world. So I wonder.

And the chart covers 200 years of massive industrial expansion, never before seen in human history. I doubt very much that trend can be extrapolated into the next 200 years. Or even the next 20 !

@uranium, what do you see for the future? More of the same? Or different?

But on the chart, there was no dip in stock valuation, 1929-1939 when the stock markets crashed all around the world. So I wonder.

And the chart covers 200 years of massive industrial expansion, never before seen in human history. I doubt very much that trend can be extrapolated into the next 200 years. Or even the next 20 !

@uranium, what do you see for the future? More of the same? Or different?

Last edited:

The first significant dip. I had this in college in the 1980s, and when you zoom in, you can see it. Right now, the view is way too high from above, so it goes unnoticed.Stocks, eh?

But on the chart, there was no dip in stock prices: 1929-1939 when the US stock market crashed. So I wonder.

I have seen similar graphs before in many of the books from investment gurus around the world. The story is always the same: no matter what crises we have had in the last 100 years, the stock market has always surged upwards after the crisis has settled.

Those who didn't sell in panic or even lost all their stocks but weathered the crisis always won big – and that is still the case today.

Those who didn't sell in panic or even lost all their stocks but weathered the crisis always won big – and that is still the case today.

If you pay attention you will see real returns underlined means inflation free.Now factor in debasement against nominal growth

Source: "Stocks for the Long Run" by Jeremy Siegel.What's the source?

All the way upStocks, eh?

But on the chart, there was no dip in stock valuation, 1929-1939 when the stock markets crashed all around the world. So I wonder.

And the chart covers 200 years of massive industrial expansion, never before seen in human history. I doubt very much that trend can be extrapolated into the next 200 years. Or even the next 20 !

@uranium, what do you see for the future? More of the same? Or different?

If you are not ready to hold until you die. Don't invest.

10 years of no growth could happen in the future example 2000 until 2010. They call it lost decade.

The USA is still biggest stock market and even international funds have big exposure to USA stocks.

All you need is to believe in USA even with much chaos happening nowadays.

Last edited:

Something that has not 200 years history yet to compare with.You forgot something:

Just on the first commentIf you pay attention you will see real returns underlined means inflation free.

Source: "Stocks for the Long Run" by Jeremy Siegel.

All the way up

If you are not ready to hold until you die. Don't invest.

10 years of no growth could happen in the future example 2000 until 2010. They call it lost decade.

The USA is still biggest stock market and even international funds have big exposure to USA stocks.

All you need is to believe in USA even with much chaos happening nowadays.

Inflation isn’t debasement

Inflation is variable goods price movement

Debasement is fixed goods price movement

Inflation is 2-4% PA dependent on whether you do the 70s calculation or the modern 21 calculation

Debasement is 8% PA.

When you do that calculation Nasdaq has outperformed debasement and inflation since 2013 but when you factor in taxes etc on top - it underperforms. S&P has outperformed inflation yes but is static against debasement and inflation.

Gold up until 2022 lost 4% PA against debasement since 2013.

Real Estate up until 2022 lost 2.5% against debasement since 2013. Both were hedges against inflation (gold/real estate).

The key is to outperform the markets by 12% hurdle rate + what ever taxes per annum - note that 12% will rise over the next few years due to the debasement rate that will rise regardless of the inflation rate.

Thing that concerns me about the US is the following.If you pay attention you will see real returns underlined means inflation free.

Source: "Stocks for the Long Run" by Jeremy Siegel.

All the way up

If you are not ready to hold until you die. Don't invest.

10 years of no growth could happen in the future example 2000 until 2010. They call it lost decade.

The USA is still biggest stock market and even international funds have big exposure to USA stocks.

All you need is to believe in USA even with much chaos happening nowadays.

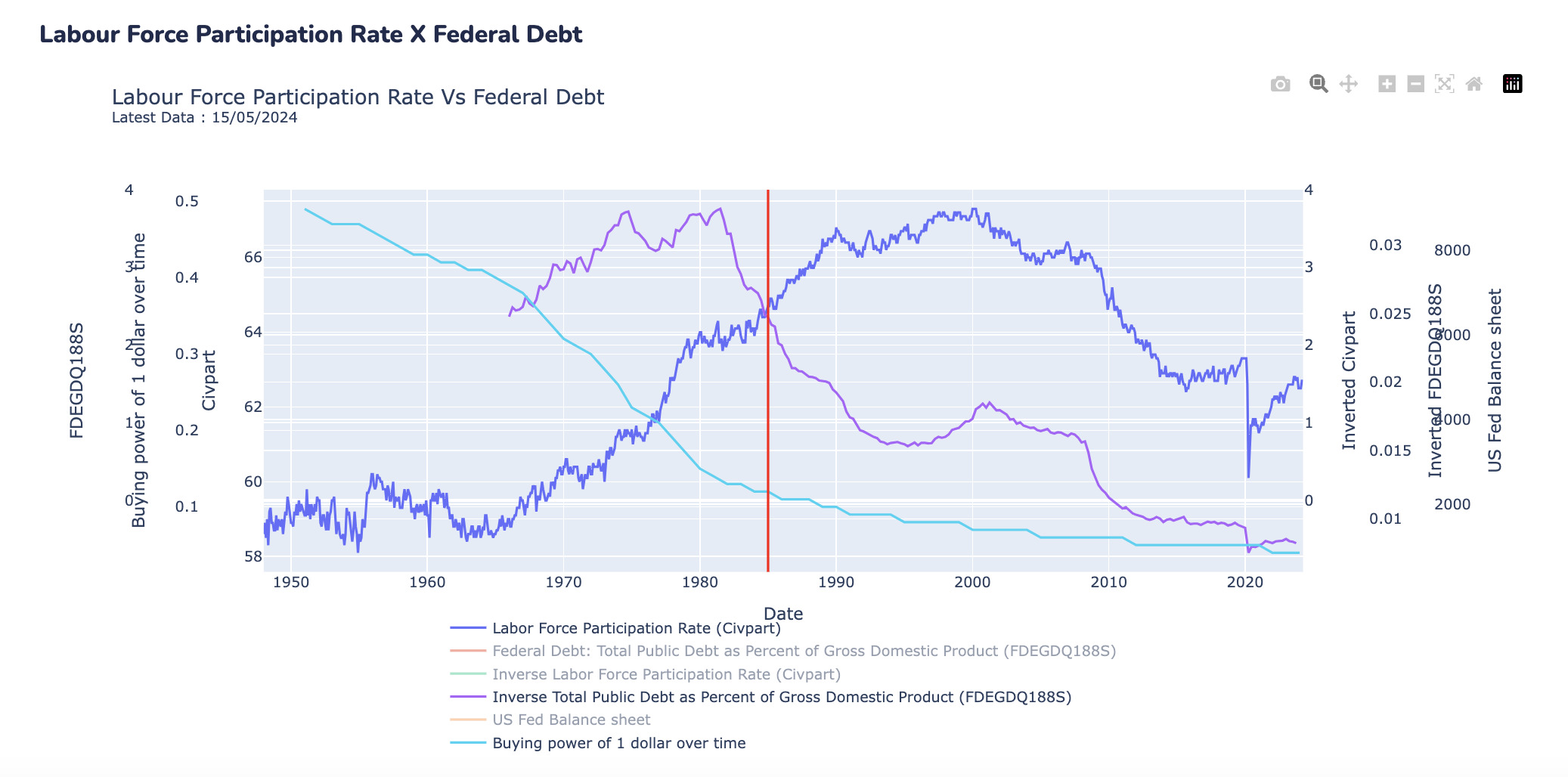

They are already debasing the $ 8% due to population+productivity decline and that will continue through to 2030.

Now factor in the following - a whole host of the wealth in the US is non US - it’s European wealth - going through retirement as the demographics collapse and look towards safe assets such as bonds due to unforeseen living length and costs - likewise Japan, China, SE Asia heading into similar which means wealth will fall out of the US markets at a time its own demographics don’t look too attractive over the next 20 or so year - ie US has peaked in real terms and the wealth will be pull back onshore away from the US.

Now the one thing that does offset the decline in productivity due to the decline in population and new entrants entering the workforce is AI - both physical and digital - the problem there is that will cause a displacement in a already screwed sub40 demographic in the West as jobs get automated - likewise heavily in white collar.

At that point - companies also get absolutely destroyed in the markets as competition cycles speed up and new ideas are replicated overnight utilizing compute power over man power.

So in that world what value does the stock market casino have with those things taken into consideration.

Also Goverment bonds the nominal value/yield what value in that world where entitlements are already exploding and the Goverment offsets by debasement occurs and now they have say 25% of their productive potential workforce without jobs ? So have to provide a source of income for them or have a revolution…

……

Again like everything it comes back in my view to - leaving the West and heading to the Global South - making wealth out of the West - East and then f*****g off to some place where you can utilize that stored up energy to sit out the Revolutions and Wars that will ultimately come out of this technological revolution in the next few dacades.

Again just my opinion and exactly what I’ve done.

We short Goverment stupidity and greed in the markets for this reason. And all of discussed above about debasement is why and how our company has outperformed this s**t and will continue to do so - because the masses refuse to accept the realities and only think a month, six months or a year ahead not decades.

Best way to observe is download and order 1-40.

I unfortunately don't have the time this evening (heading out for italiano).

Attachments

Last edited:

Impressive work!Just on the first comment

Inflation isn’t debasement

Inflation is variable goods price movement

Debasement is fixed goods price movement

Inflation is 2-4% PA dependent on whether you do the 70s calculation or the modern 21 calculation

Debasement is 8% PA.

When you do that calculation Nasdaq has outperformed debasement and inflation since 2013 but when you factor in taxes etc on top - it underperforms. S&P has outperformed inflation yes but is static against debasement and inflation.

Gold up until 2022 lost 4% PA against debasement since 2013.

Real Estate up until 2022 lost 2.5% against debasement since 2013. Both were hedges against inflation (gold/real estate).

The key is to outperform the markets by 12% hurdle rate + what ever taxes per annum - note that 12% will rise over the next few years due to the debasement rate that will rise regardless of the inflation rate.

Thing that concerns me about the US is the following.

They are already debasing the $ 8% due to population+productivity decline and that will continue through to 2030.

Now factor in the following - a whole host of the wealth in the US is non US - it’s European wealth - going through retirement as the demographics collapse and look towards safe assets such as bonds due to unforeseen living length and costs - likewise Japan, China, SE Asia heading into similar which means wealth will fall out of the US markets at a time its own demographics don’t look too attractive over the next 20 or so year - ie US has peaked in real terms and the wealth will be pull back onshore away from the US.

Now the one thing that does offset the decline in productivity due to the decline in population and new entrants entering the workforce is AI - both physical and digital - the problem there is that will cause a displacement in a already screwed sub40 demographic in the West as jobs get automated - likewise heavily in white collar.

At that point - companies also get absolutely destroyed in the markets as competition cycles speed up and new ideas are replicated overnight utilizing compute power over man power.

So in that world what value does the stock market casino have with those things taken into consideration.

Also Goverment bonds the nominal value/yield what value in that world where entitlements are already exploding and the Goverment offsets by debasement occurs and now they have say 25% of their productive potential workforce without jobs ? So have to provide a source of income for them or have a revolution…

……

Again like everything it comes back in my view to - leaving the West and heading to the Global South - making wealth out of the West - East and then f*****g off to some place where you can utilize that stored up energy to sit out the Revolutions and Wars that will ultimately come out of this technological revolution in the next few dacades.

Again just my opinion and exactly what I’ve done.

We short Goverment stupidity and greed in the markets for this reason. And all of discussed above about debasement is why and how our company has outperformed this s**t and will continue to do so - because the masses refuse to accept the realities and only think a month, six months or a year ahead not decades.

View attachment 6811View attachment 6812View attachment 6813View attachment 6814View attachment 6815View attachment 6816View attachment 6817View attachment 6818View attachment 6819View attachment 6820View attachment 6821View attachment 6822View attachment 6823View attachment 6824View attachment 6825View attachment 6826View attachment 6827View attachment 6828View attachment 6829View attachment 6830View attachment 6831View attachment 6832View attachment 6833View attachment 6834View attachment 6835View attachment 6831View attachment 6832View attachment 6832View attachment 6831View attachment 6835View attachment 6834View attachment 6833

View attachment 6839View attachment 6839View attachment 6840View attachment 6841View attachment 6842View attachment 6843View attachment 6844View attachment 6847View attachment 6848View attachment 6849

View attachment 6850View attachment 6851View attachment 6852View attachment 6853View attachment 6854View attachment 6855View attachment 6856View attachment 6857View attachment 6858View attachment 6859

View attachment 6860View attachment 6861View attachment 6862View attachment 6863View attachment 6864View attachment 6865View attachment 6866View attachment 6867View attachment 6868

Best way to observe is download and order 1-40.

I unfortunately don't have the time this evening (heading out for italiano).

1-

- Debasement gives more money to governments for spending while it results in inflation for citizens.

2-

I checked nasdaq 100 performance while it beat spx but drawdown is too high

Max Drawdown-82.90%

3- as both classic and modern investor I invested my networth into 2 asset:

50% Voo

50% Btc

The future of btc = 99% of all coins will be owned by Blackrock and the only way to invest in btc is through etfs.

Most big retirement funds will keep investing in us stocks and these stocks represent big companies like apple who have huge cash flow and who keep investing into development so they will keep growing.

Ai will boost tech sector and most index funds will increase their shares of technology sector.

I believe in 50 years from now, robots will serve humans and we no longer need to work. It will be true freedom, every human will get same salary from Goverment which will be enough to live well and do your hobbies.

1) Debasement (though it might seep into Variable Goods/Services as a inflation -> small%) isn't really a inflation thing.Impressive work!

1-

So why should I care about debasement, I only care about inflation as an investor and it will never be higher than sp500 return or economy collapse will happen.

- Debasement gives more money to governments for spending while it results in inflation for citizens.

2-

I checked nasdaq 100 performance while it beat spx but drawdown is too high

Max Drawdown-82.90%

3- as both classic and modern investor I invested my networth into 2 asset:

50% Voo

50% Btc

The future of btc = 99% of all coins will be owned by Blackrock and the only way to invest in btc is through etfs.

Most big retirement funds will keep investing in us stocks and these stocks represent big companies like apple who have huge cash flow and who keep investing into development so they will keep growing.

Ai will boost tech sector and most index funds will increase their shares of technology sector.

I believe in 50 years from now, robots will serve humans and we no longer need to work. It will be true freedom, every human will get same salary from Goverment which will be enough to live well and do your hobbies.

I.E debasement commenced in 2008 but really took off in 2013, this hasn't really impacted the price of goods and services, but has exploded assets prices, this is because the funds sit on the balance sheets of Governments and is rehypothecated within the markets by its derivative (bonds/coupons etc) which is mixed and mingled with asset bonds/coupons, and seeps into Global Liquidity and from there into asset markets, hence price of a house when my grandmother bought in 1947 was 500 pounds, grandfather in 1977 17,000 pounds, father in 1995 66,000 pounds and myself in 2010 1180,000 pounds, the same house today laid out

Grandmother 1.1m

Grandfather 1.3m

Father 600,000

Me 450,000

The debasement coupled with demand / supply imbalances and location demand drive the prices of assets, note mine was outside of the Capital, my father also, the other two much further afield, so even though they repriced with the inflation period(s) they didn't reprice well with the debasement periods, hence you get an averaged -2.5% real-estate loss against debasement (though it outperforms inflation) due to the imbalance - naturally - debasement socialises the cost of the debt on income earners and rewards asset owners as the prices price the avg people into higher debts for the same property/asset(s) or into poverty as they are not able to obtain a foothold.

Now when it comes to the S&P/SPX that has massively outperformed inflation - granted but that's only 2% (or 4%) YoY, whereas debasement is 8% so at 10.26 annualised that's sub 2.x% against debasement but because there's periods of high growth it can be considered flat, or at worse -future self, poorer than current self in spending power (real) ergo optical illusion 'number go up'..

Nasdaq has high draw downs, but it also has high draw ups 26k for example is the expected by end of 2025 currently its 18.5k the support for Nasdaq is it is technology and technology displaces the real world impact of declining population, therefore productivity, it's also in a 45-65 month cyclical trend.

- Just on this "I believe in 50 years from now - that's my field, i can't talk about the rest of that statement except saying - leave - it won't be 50 yrs, it will gutter blue collar and white collar industries like a cheese grater... it is already...

I agree with most of the facts you stated1) Debasement (though it might seep into Variable Goods/Services as a inflation -> small%) isn't really a inflation thing.

I.E debasement commenced in 2008 but really took off in 2013, this hasn't really impacted the price of goods and services, but has exploded assets prices, this is because the funds sit on the balance sheets of Governments and is rehypothecated within the markets by its derivative (bonds/coupons etc) which is mixed and mingled with asset bonds/coupons, and seeps into Global Liquidity and from there into asset markets, hence price of a house when my grandmother bought in 1947 was 500 pounds, grandfather in 1977 17,000 pounds, father in 1995 66,000 pounds and myself in 2010 1180,000 pounds, the same house today laid out

Grandmother 1.1m

Grandfather 1.3m

Father 600,000

Me 450,000

The debasement coupled with demand / supply imbalances and location demand drive the prices of assets, note mine was outside of the Capital, my father also, the other two much further afield, so even though they repriced with the inflation period(s) they didn't reprice well with the debasement periods, hence you get an averaged -2.5% real-estate loss against debasement (though it outperforms inflation) due to the imbalance - naturally - debasement socialises the cost of the debt on income earners and rewards asset owners as the prices price the avg people into higher debts for the same property/asset(s) or into poverty as they are not able to obtain a foothold.

Now when it comes to the S&P/SPX that has massively outperformed inflation - granted but that's only 2% (or 4%) YoY, whereas debasement is 8% so at 10.26 annualised that's sub 2.x% against debasement but because there's periods of high growth it can be considered flat, or at worse -future self, poorer than current self in spending power (real) ergo optical illusion 'number go up'..

Nasdaq has high draw downs, but it also has high draw ups 26k for example is the expected by end of 2025 currently its 18.5k the support for Nasdaq is it is technology and technology displaces the real world impact of declining population, therefore productivity, it's also in a 45-65 month cyclical trend.

- Just on this "I believe in 50 years from now - that's my field, i can't talk about the rest of that statement except saying - leave - it won't be 50 yrs, it will gutter blue collar and white collar industries like a cheese grater... it is already...

The numbers and examples you gave are correct

But for now what matters to me is

Voo producing me 7% return inflation free.

Btc tripling every 4 years.

I can't ask for more.

For how long have you hold your BTC if it is OK to ask?Btc tripling every 4 years.

I'm new to crypto world and I own it through etfFor how long have you hold your BTC if it is OK to ask?

Now most members will start laughing

Question should be how long I will hold it for = until I die.

okay, that's a strange strategyQuestion should be how long I will hold it for = until I die.

Kids = no way!okay, that's a strange strategywhy until you die, do you want to keep it for your kids or other family members?

Stay alone = stay rich

The only reason is whenever Voo doesn't deliver, btc will. It is hedging strategy.

that's a perfectly sensible strategy - you hold BTC forever (for yourself and your successors if you want) and liquidate only what you need to spend for consumption/pleasure/needs or venture with a potential to beat BTC (good luck though)okay, that's a strange strategywhy until you die, do you want to keep it for your kids or other family members?

Now for those that still wish to believe in the fairy tale of free-markets and it's all driven by wild productivity that can not be surmised, guessed, predicted pre-emptively.

(US Stocks)

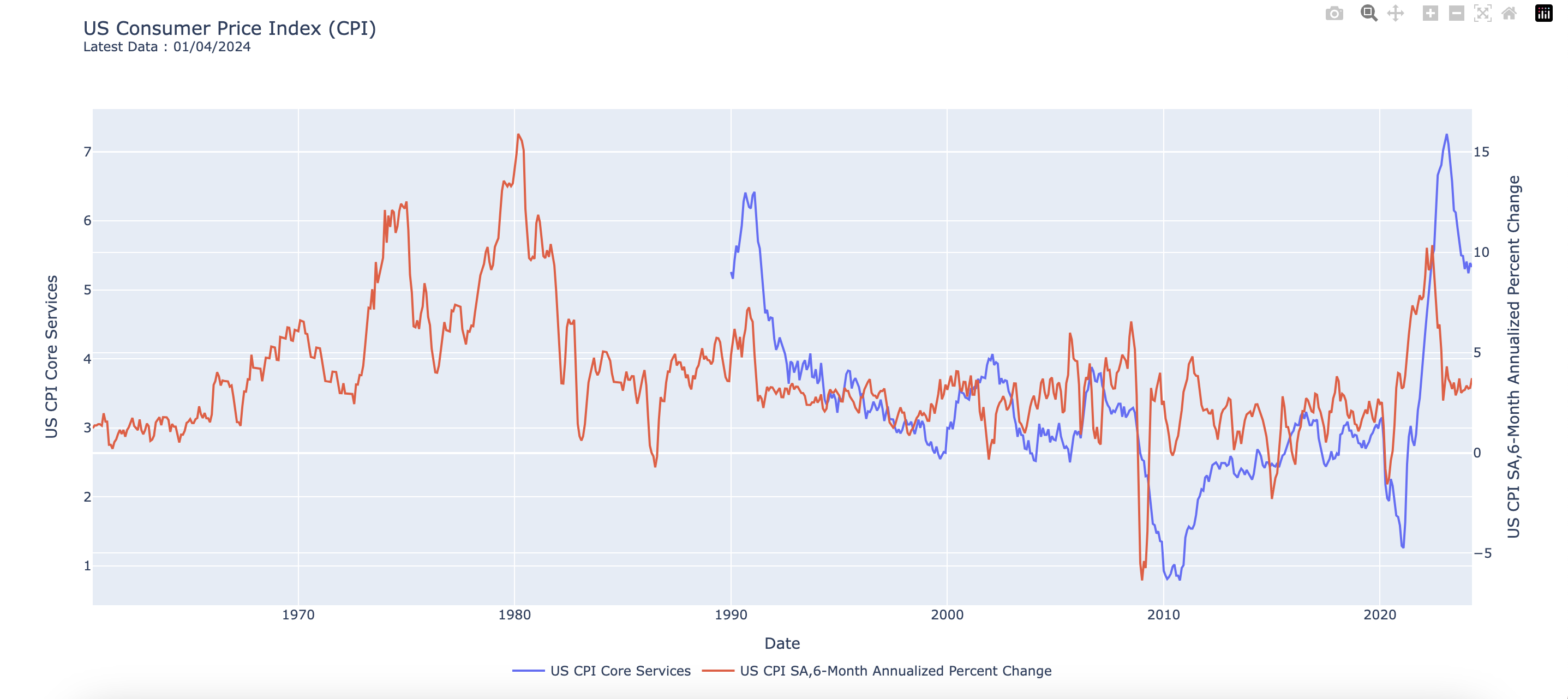

US Consumer Price Index (CPI) - 1990 (this was technically the first cross over period) vs 6 Months annualised % change .... looks random right.

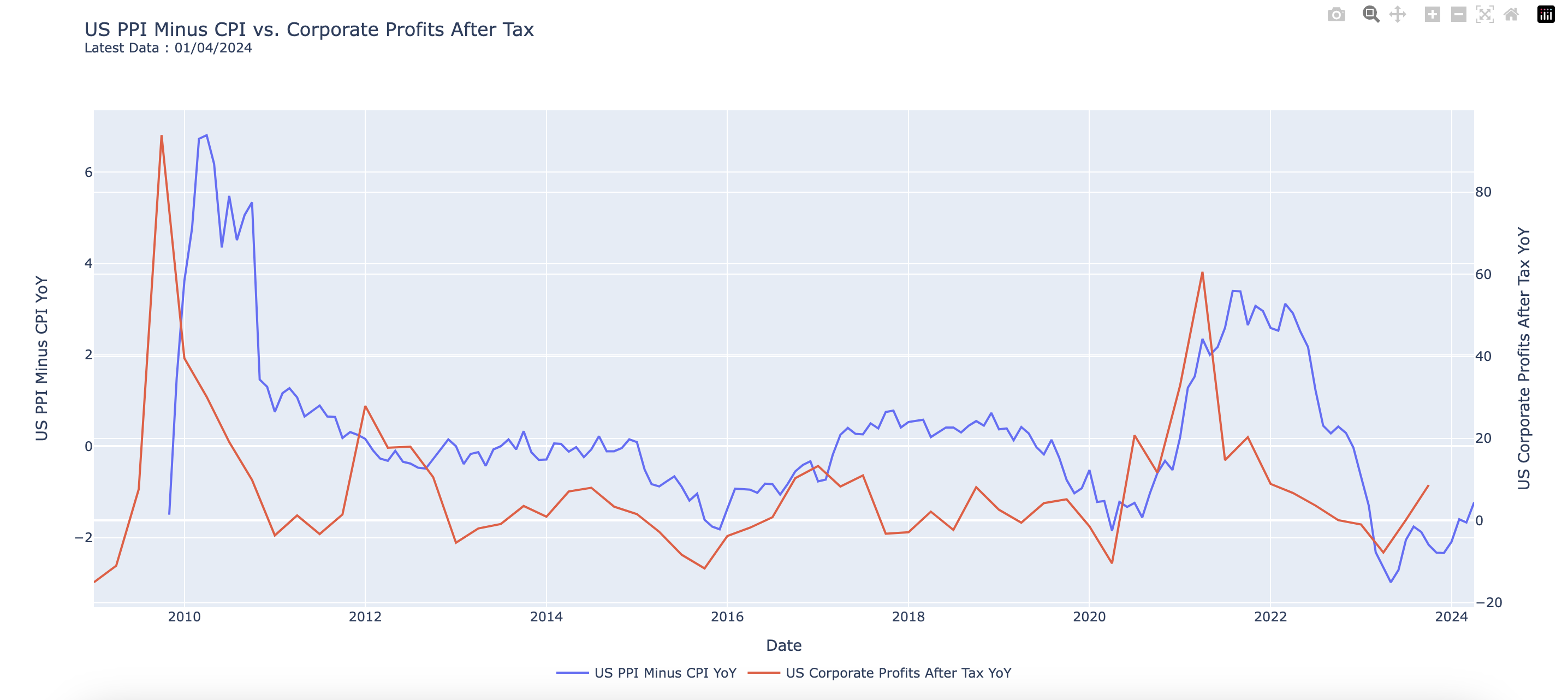

Now look at US PPI Minus CPI vs Corporate Profits after Tax.

Oh that's weird - they are synchronised... hmmmmmm...

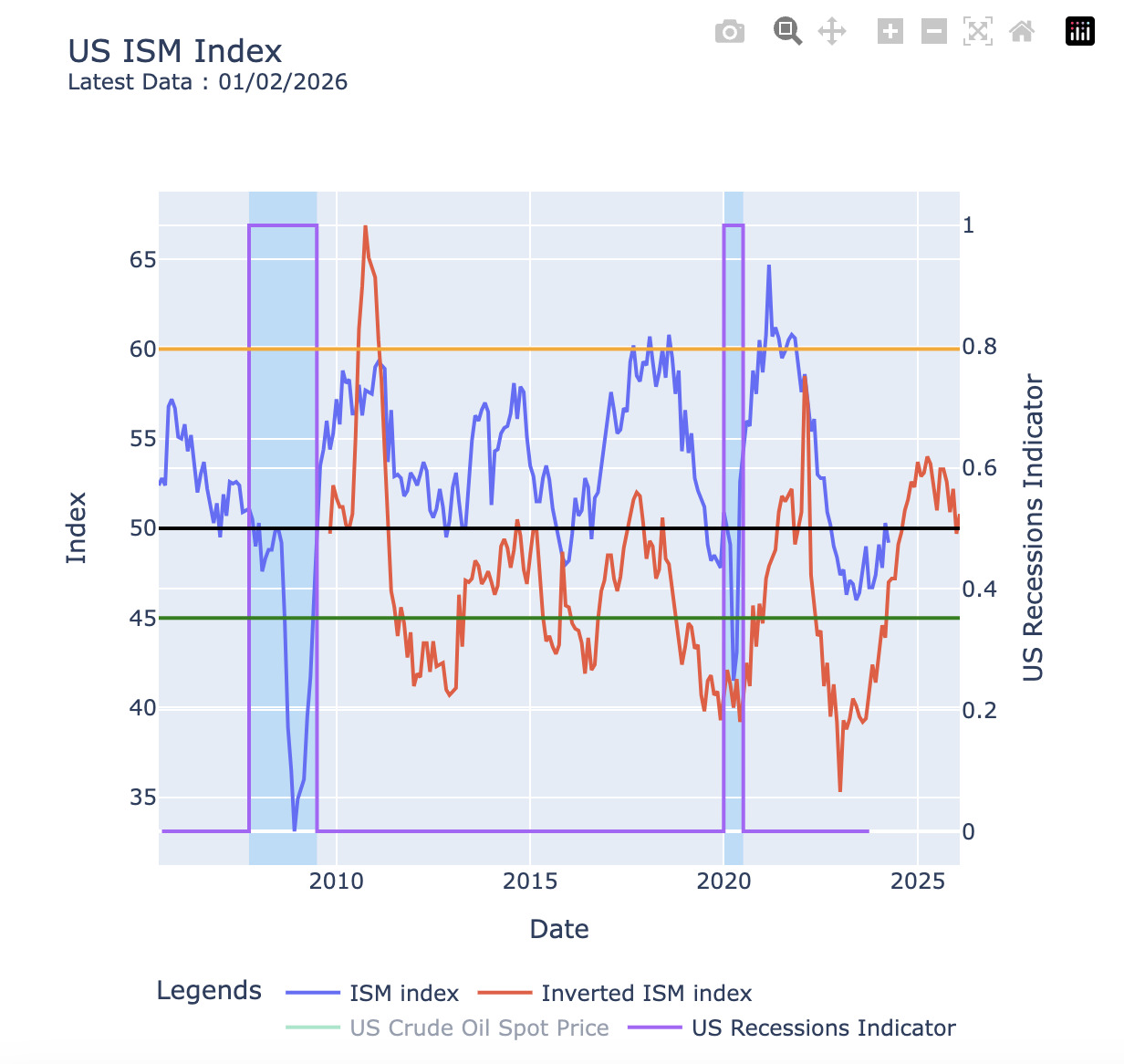

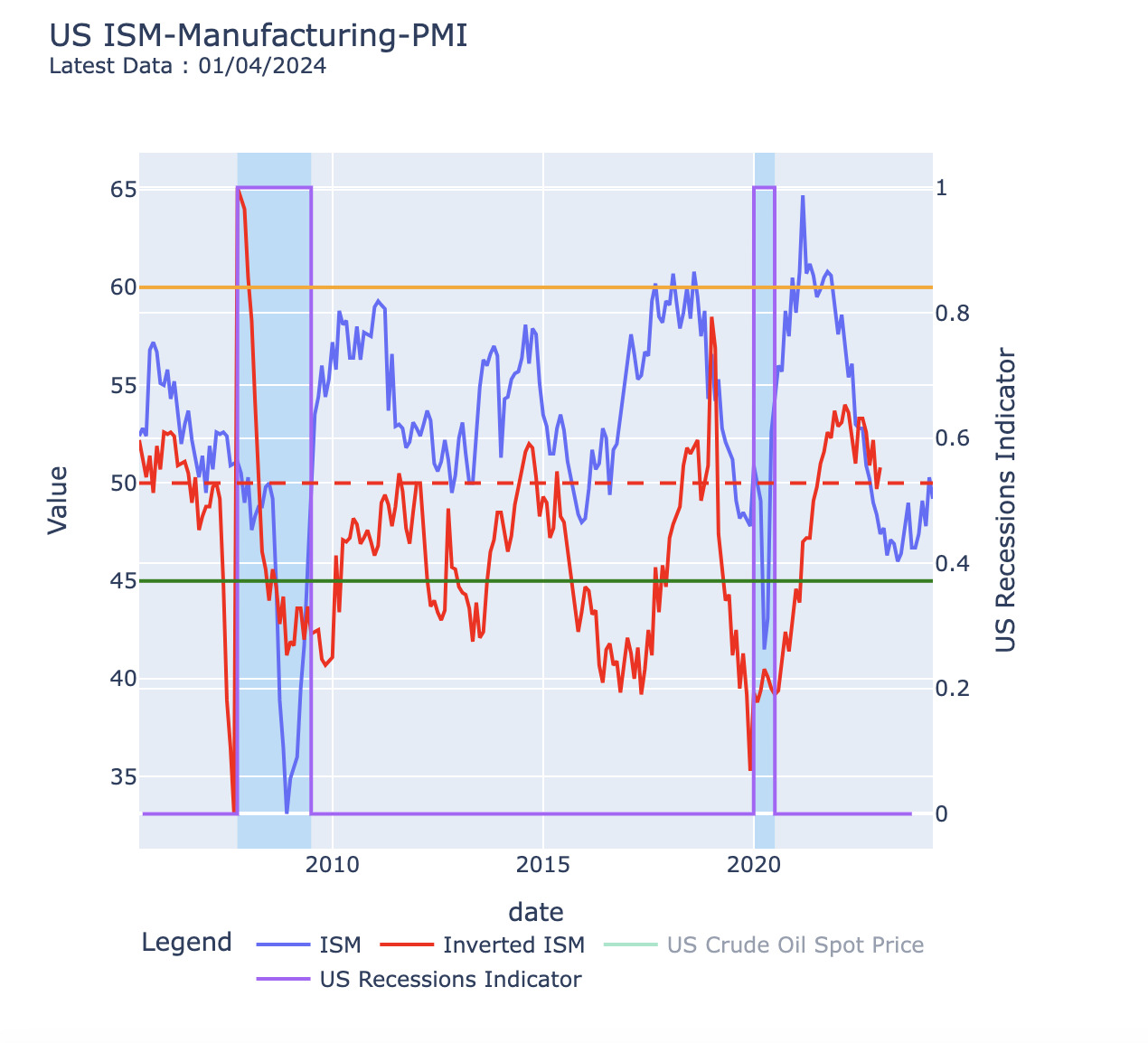

Well, PPI lags CPI, & CPI is a lagging impact on the markets and led by the business cycle and as we can see business cycle profits minus taxes follows PPI, and all of these follow the ISM in a manner of speaking, the ISM... therefore is the next area you need to peruse.

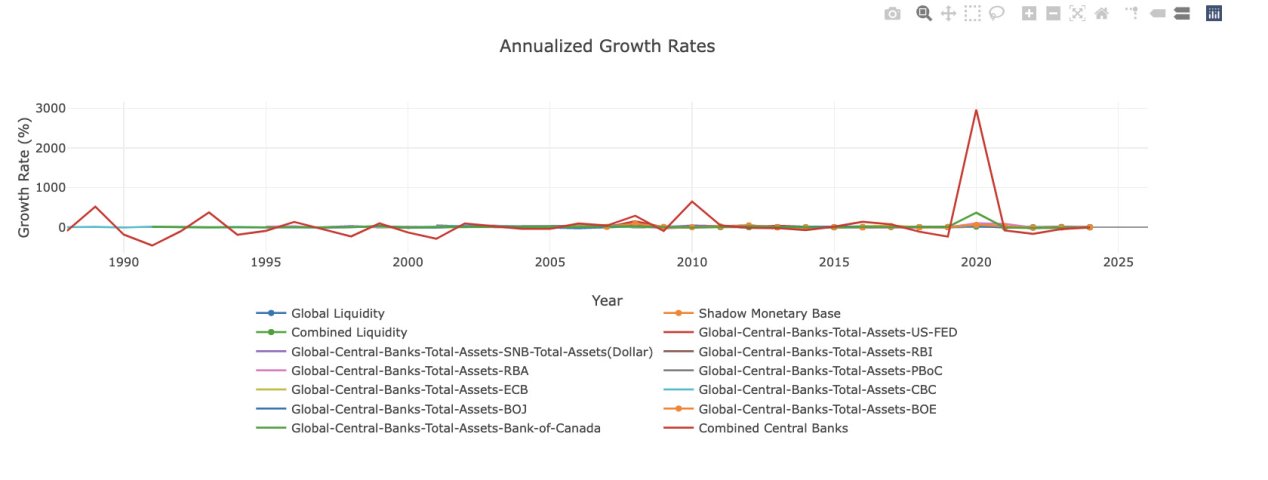

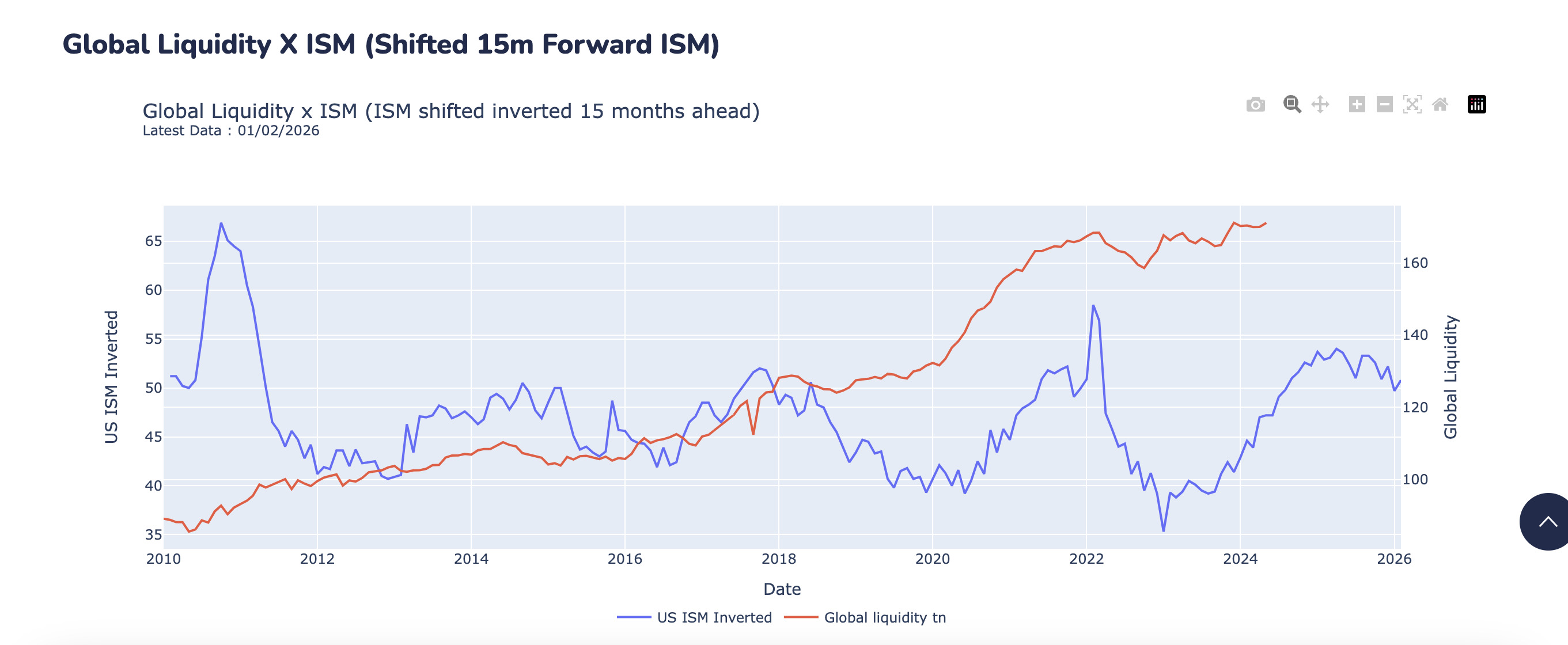

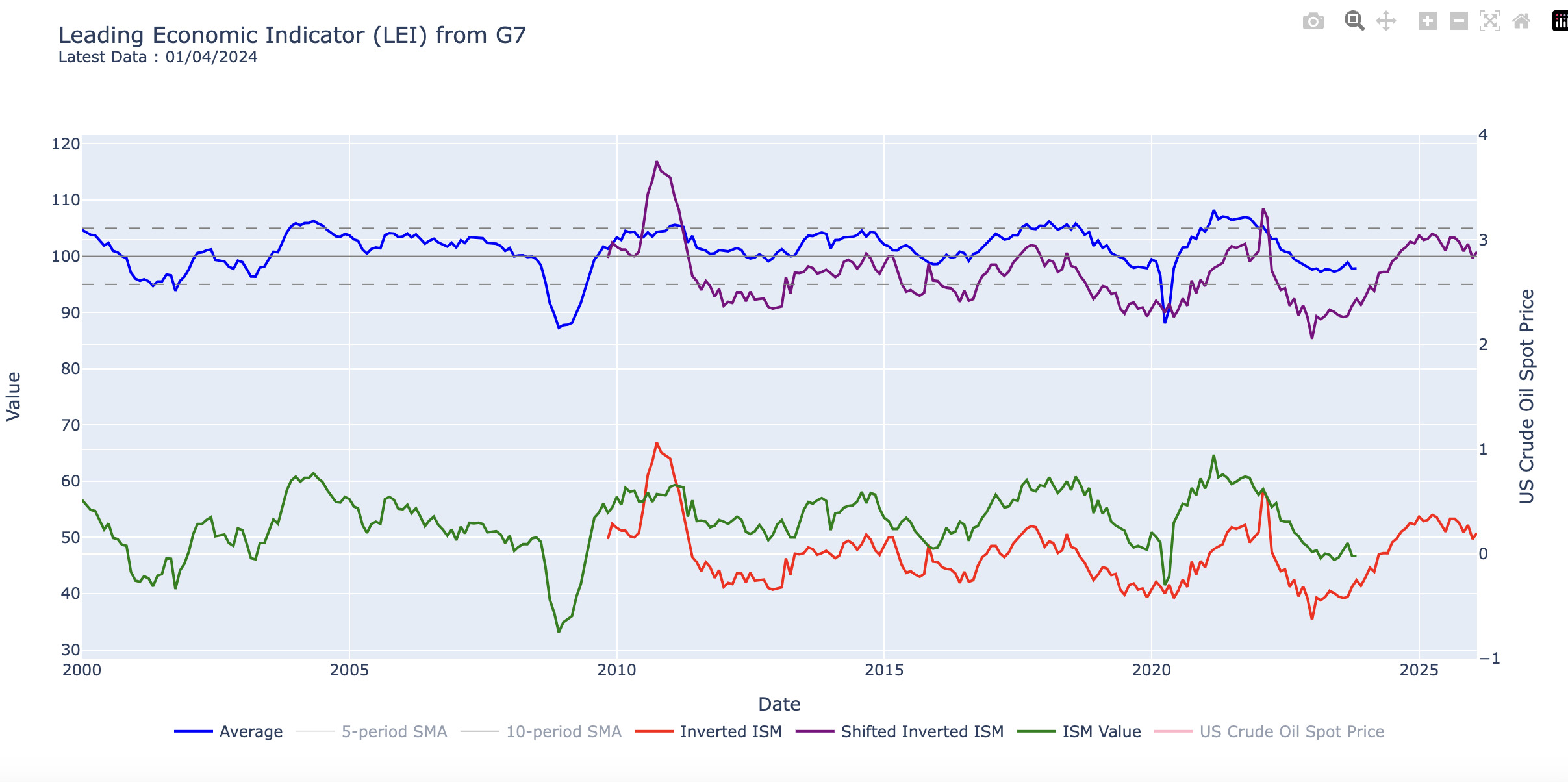

Observe ISM (US ISM Follows China Credit Liquidity Impulse by 6 months - and follows Global Liquidity by roughly 15-18 months) -> but CB Liquidity takes 52 weeks to hit Global Liquidity -> then from there weeks to months into the markets.

Note 2018 onwards... that was the last breakage in the system (2018/19 rate hike attempt).

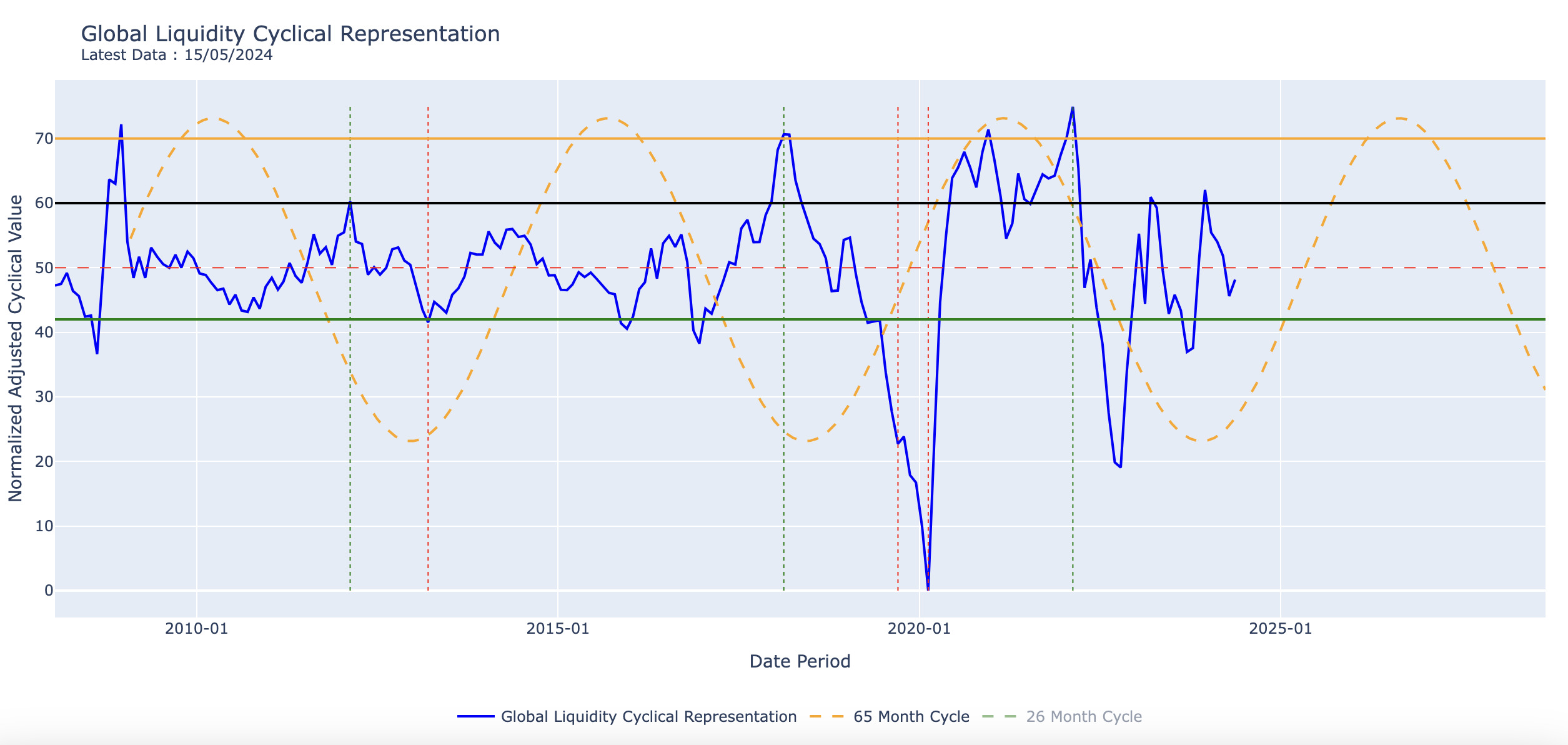

Global Liquidity Cycles

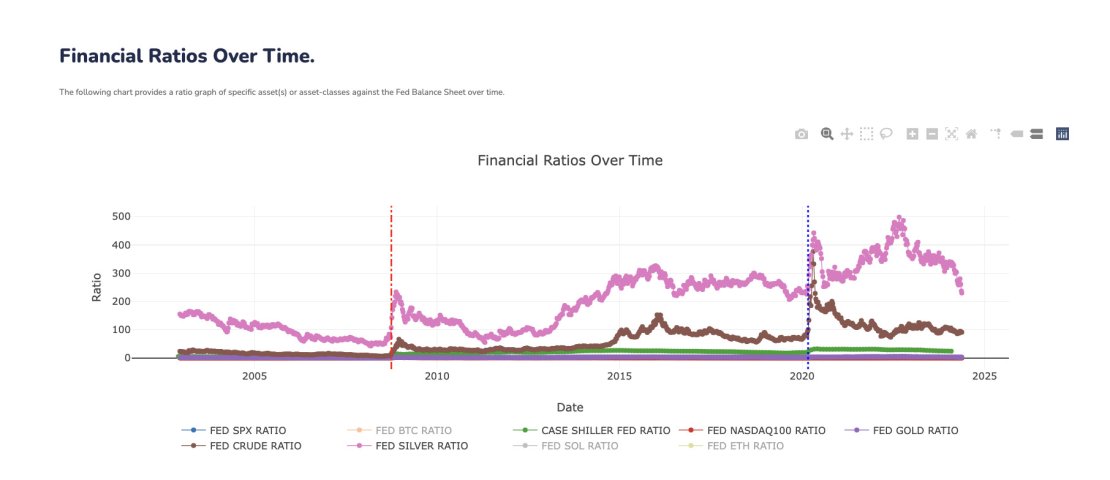

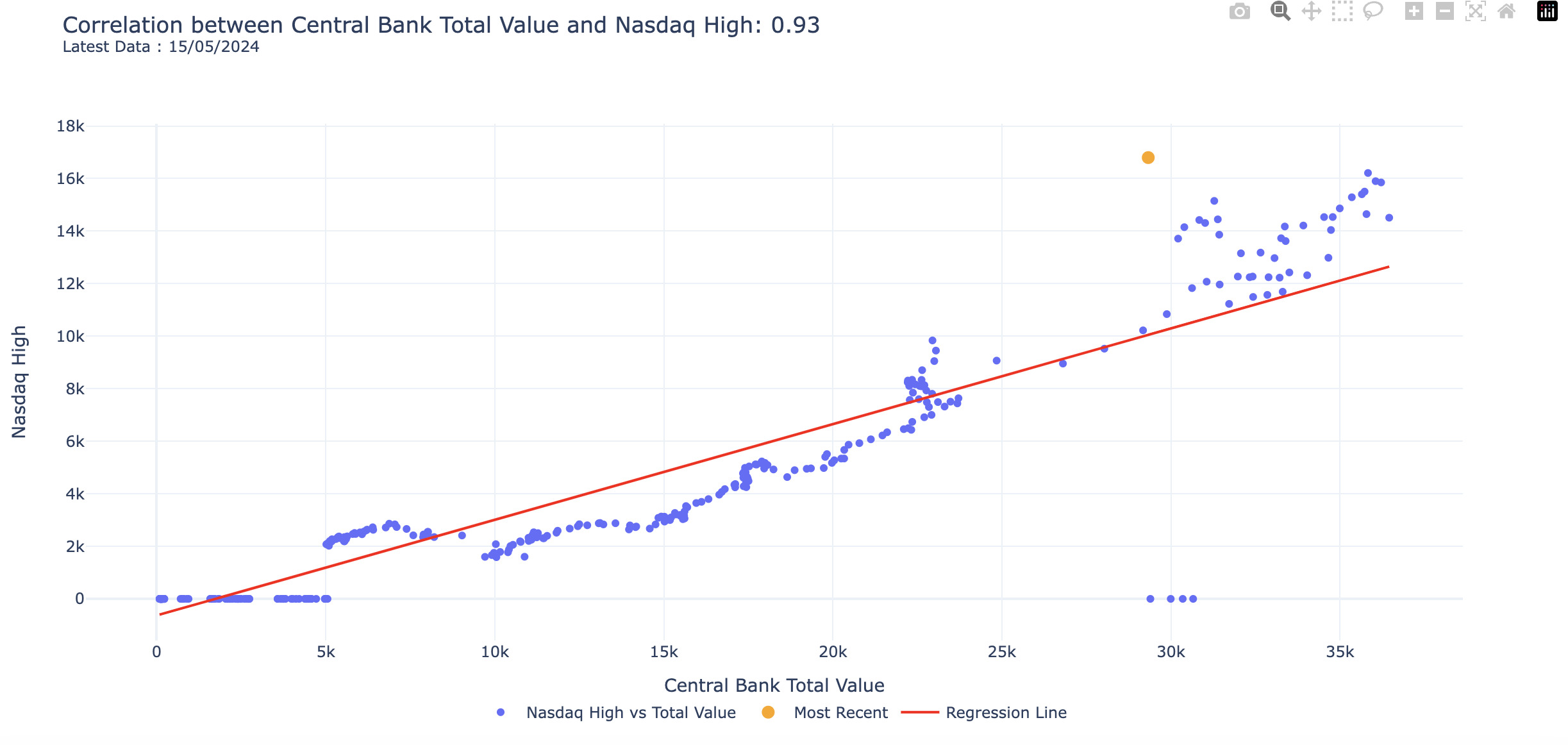

Correlation between Central Bank Value (FED) and Nasdaq (= Nasdaq is lifted by Fed Balance Sheet) -> Fed tightens to pull in funds to roll over debts every X yrs to service the interest at a lower rate i.e it crowds out the markets to pull in liquidity -> hence pull backs Nasdaq etc (mentioned above) time those periods against rate hikes you have your answer, then observe liquidity flows.

G7 as synchronised (they all follow papa bear). oh look you can clearly see the future... you can also show the past, as ISM leads... you know where the markets go in the future as the inverted value as its all re-financing provides a path to a cycle of the past and the future....

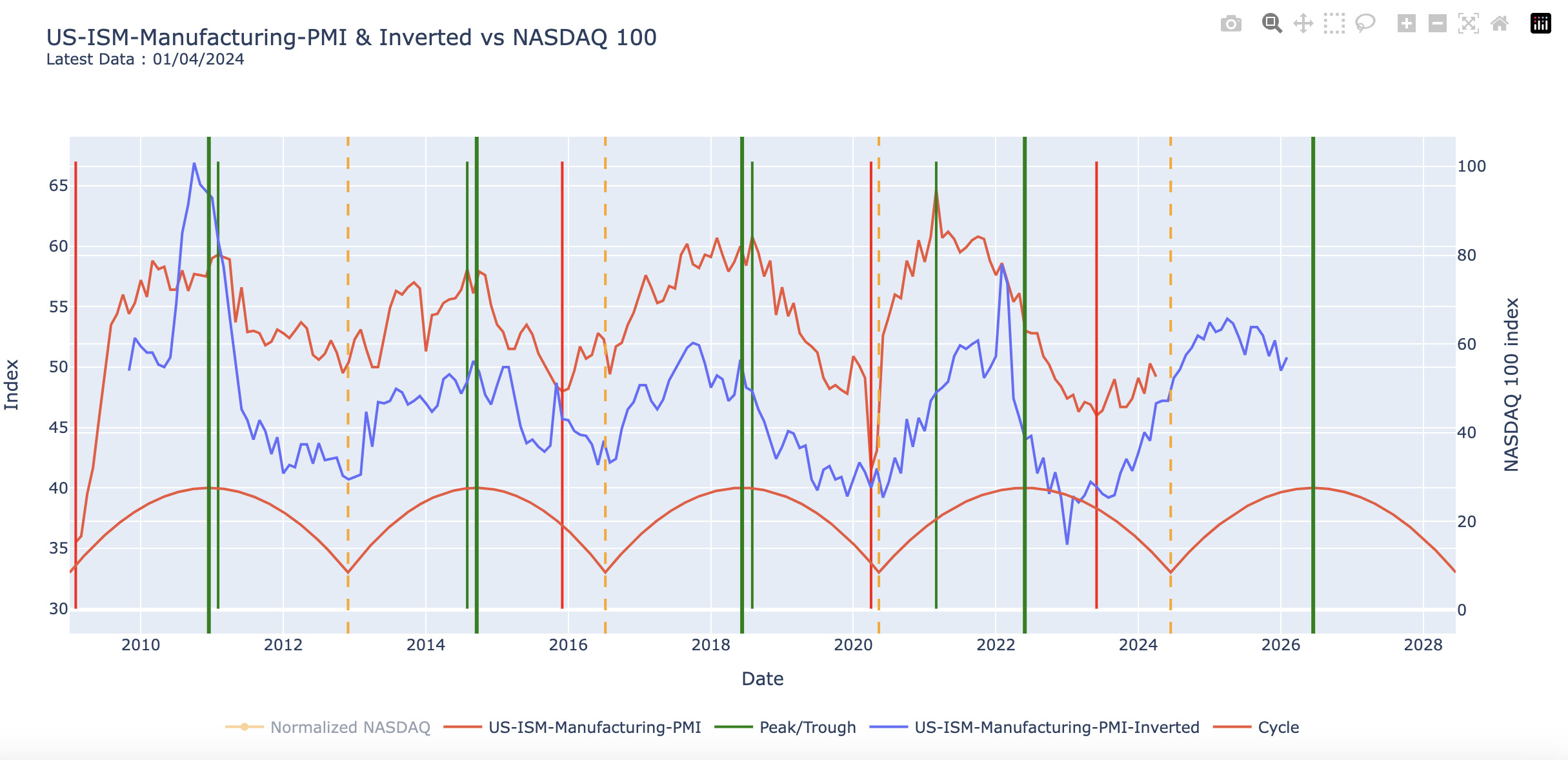

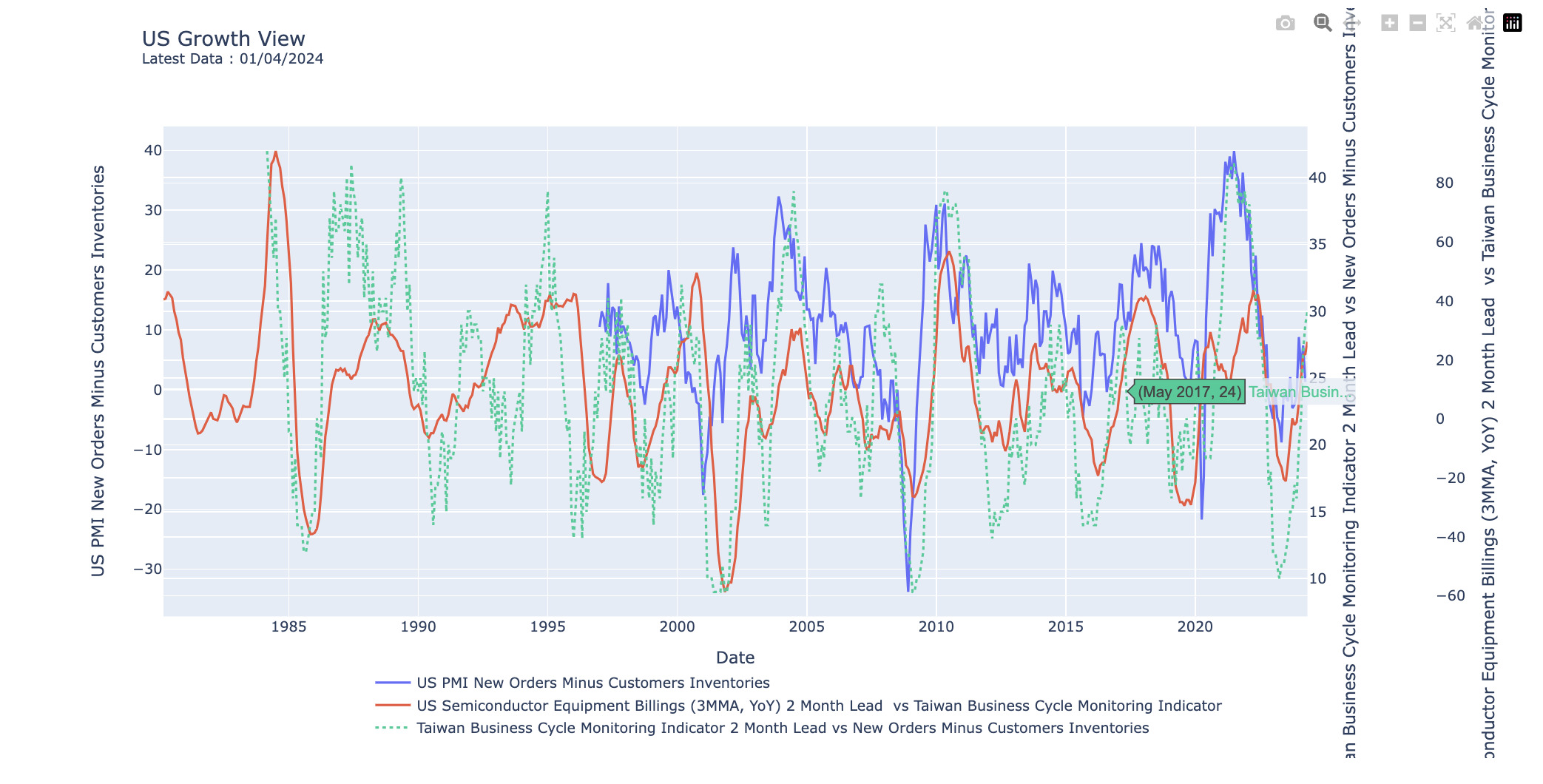

Now you can go into the US Markets specifically ISM, PMI's vrs their respected Inverted -> then tie up against volatility in NDX -> you know where that's going based on liquidity, inverted.

When you have all that figured out, for every $ position against debasement you take (essentially against Goverments) you’ll be able to hundreds to thousands without leverage by leveraging the risk curve in assets against greed in the market cycles, liquidity cycles and tightening cycles.

You therefore premptive know what assets, what entry zone and what exit zone.

And at that point 8,16,50% growth in a year becomes dull - and you only want that as residual store of value assets that are deflationary whilst your main allocation adds to it every cycle.

(US Stocks)

US Consumer Price Index (CPI) - 1990 (this was technically the first cross over period) vs 6 Months annualised % change .... looks random right.

Now look at US PPI Minus CPI vs Corporate Profits after Tax.

Oh that's weird - they are synchronised... hmmmmmm...

Well, PPI lags CPI, & CPI is a lagging impact on the markets and led by the business cycle and as we can see business cycle profits minus taxes follows PPI, and all of these follow the ISM in a manner of speaking, the ISM... therefore is the next area you need to peruse.

Observe ISM (US ISM Follows China Credit Liquidity Impulse by 6 months - and follows Global Liquidity by roughly 15-18 months) -> but CB Liquidity takes 52 weeks to hit Global Liquidity -> then from there weeks to months into the markets.

Note 2018 onwards... that was the last breakage in the system (2018/19 rate hike attempt).

Global Liquidity Cycles

Correlation between Central Bank Value (FED) and Nasdaq (= Nasdaq is lifted by Fed Balance Sheet) -> Fed tightens to pull in funds to roll over debts every X yrs to service the interest at a lower rate i.e it crowds out the markets to pull in liquidity -> hence pull backs Nasdaq etc (mentioned above) time those periods against rate hikes you have your answer, then observe liquidity flows.

G7 as synchronised (they all follow papa bear). oh look you can clearly see the future... you can also show the past, as ISM leads... you know where the markets go in the future as the inverted value as its all re-financing provides a path to a cycle of the past and the future....

Now you can go into the US Markets specifically ISM, PMI's vrs their respected Inverted -> then tie up against volatility in NDX -> you know where that's going based on liquidity, inverted.

When you have all that figured out, for every $ position against debasement you take (essentially against Goverments) you’ll be able to hundreds to thousands without leverage by leveraging the risk curve in assets against greed in the market cycles, liquidity cycles and tightening cycles.

You therefore premptive know what assets, what entry zone and what exit zone.

And at that point 8,16,50% growth in a year becomes dull - and you only want that as residual store of value assets that are deflationary whilst your main allocation adds to it every cycle.

Attachments

Last edited:

Any strategy to mitigate sequence of returns risk, and avoid selling during bear market?that's a perfectly sensible strategy - you hold BTC forever (for yourself and your successors if you want) and liquidate only what you need to spend for consumption/pleasure/needs or venture with a potential to beat BTC (good luck though)

Latest Threads

-

-

-

Payment gateway for EVC (Expedia Virtual Card)

- Started by diskoteka

- Replies: 0

-

-

-

-

Best place to register offshore company with nominees, privacy question?

- Started by justnew

- Replies: 7

-

Common Reporting Standard / Revolut CRS

- Started by kpeter440

- Replies: 11

-