What you suggest makes sense but requires to follow the market actively, which I no longer want to do. So I leave that to the pros: as you see I hold a few funds that play with options. This way I make less money but I am healthier.Everybody does.

If you want income maybe just holding SPY and selling low-risk further OTM weekly or monthly covered calls could get you about 1% return (including SPY dividend) per month on capital. Buying back right away when assigned.

I would split 80/20 SPY/QQQ applying same strategy for a bit of more growth/income.

Agreed that this is not 100% passive.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IBKR portfolio

- Thread starter TurnedToRobot2

- Start date

- Status

- Not open for further replies.

What is it you try to do then, if I may ask?Yes I suck at beating the SPY, which btw is not what I want to do.

I feel your allocation would benefit from your own fixed-income purchases and no concentration in small-caps (small-caps are known to underperform).

There is also a very high amount of fixed-income ETFs that have a +1% expense ratio which is really eating into your ROI over a longer time period.

My quick evaluation of almost every instrument:

DBMF -> This product is:

- Heavy on cash (collecting interest).

- Heavy on T-Bills

- Long on Euro and WTI futures

Short:

- Gold

- MSCI Emerging Markets

- US Bonds Dec23 expiration (betting on dovish remarks from JPOW).

GOF:

- Heavy expense ratio -> 2.88%! annually for 8% YTD returns

- Extremely poor returns

I would advise against buying fixed-income funds. It is always better to just buy fixed-income products yourself (you can do bond subscriptions yourself on IBKR).

GWX:

- Small caps have always been poor performers. 80% of gains are created by 20% of companies approx.

HIGH:

- Another fixed-income ETF

INDA:

- Interesting although why would you opt for a fund if you can just buy the index yourself?

JPIE:

- Yet another fixed-income ETF

MCHI:

- 1% returns in 10 years, yikes.

MMM:

- Do not know your thesis behind 3M

RIVN:

- Company with no profits valued at 18B, would only buy with strong industry or insider knowledge.

RYLD:

- Covered calls on small-cap stocks? Why? The bulk are profits are captured by a small set of superstar-companies. Read: Exponential: How Accelerating Technology Is Leaving Us Behind and What to Do About It: Amazon.co.uk: Azhar, Azeem: 9781847942906: Books

SDIV:

- Interesting product at a decent price (expense ratio)

SPHY:

- Fixed-income ETF again

SPY:

- Always good if not the best, even for the coming century.

SPYI:

- Another fixed-income ETF

SVOL:

- Interesting hedge or directional play

VT:

- Just buy whatever is in here yourself

VZ:

- A telecom company dominating the US market trading at 7.71 P/E and with a fat div-yield. Nice!

Just buy some bonds from countries you think will outperform, buy their indices and / or some some ETFs, and if you like them buy some dividend aristocrat ETFs. Don't concentrate in small-caps.I leave that to the pros

Especially in the current interest rate environment bonds seem to be a no-brainer if you want steady income. You can buy US and EU bonds on IBKR and collect a good coupon with your only worry being the Western World collapsing.

And if you are into BRICS, try to see if you can find USD-denominated BRICS-bonds (or in their own currency if you think the USD is on it's path down but that is up to you).

For pure dividends there are good options like:

- Altria keeps giving

- Enegas is lovely (Spanish gas-company with fat dividends).

- Oil refiners in the US used to be my main rec. (like MPC) but they ran up so-hard they are hard to recommend with full conviction.

- PepsiCo is priced very attractive currently

- Newell Holdings is well priced right now imo.

- IBM pays 4% dividend while being a respectable tech-stock.

Last edited:

Income (plus some extra pickings)What is it you try to do then, if I may ask?

I think they are worth itThere is also a very high amount of fixed-income ETFs that have a +1% expense ratio which is really eating into your ROI over a longer time period.

The strategy is dynamic, correlation is low and dividends are high (8+%)My quick evaluation of almost every instrument:

DBMF -> This product is:

- Heavy on cash (collecting interest).

- Heavy on T-Bills

- Long on Euro and WTI futures

Short:

- Gold

- MSCI Emerging Markets

- US Bonds Dec23 expiration (betting on dovish remarks from JPOW).

16% dividendsGOF:

- Heavy expense ratio -> 2.88%! annually for 8% YTD returns

- Extremely poor returns

I already hold bonds elsewhereI would advise against buying fixed-income funds. It is always better to just buy fixed-income products yourself (you can do bond subscriptions yourself on IBKR).

“Always” doesn’t mean “forever will”GWX:

- Small caps have always been poor performers. 80% of gains are created by 20% of companies approx.

9+% dividendsHIGH:

- Another fixed-income ETF

Do you mean the futures or the single components (131)?INDA:

- Interesting although why would you opt for a fund if you can just buy the index yourself?

5.7%JPIE:

- Yet another fixed-income ETF

I bought it in 2022MCHI:

- 1% returns in 10 years, yikes.

5.8% dividendsMMM:

- Do not know your thesis behind 3M

Bought at 16.17 based on value considerations.RIVN:

- Company with no profits valued at 18B, would only buy with strong industry or insider knowledge.

To balance the other funds trading optionsRYLD:

- Covered calls on small-cap stocks? Why? The bulk are profits are captured by a small set of superstar-companies. Read: Exponential: How Accelerating Technology Is Leaving Us Behind and What to Do About It: Amazon.co.uk: Azhar, Azeem: 9781847942906: Books

11.7% dividendsSDIV:

- Interesting product at a decent price (expense ratio)

8% dividendsSPHY:

- Fixed-income ETF again

Bought it in this context just to balance SPYISPY:

- Always good if not the best, even for the coming century.

12.2% dividendsSPYI:

- Another fixed-income ETF

Non correlated, 16.3% dividendsSVOL:

- Interesting hedge or directional play

4,594 holdings?VT:

- Just buy whatever is in here yourself

6.9% dividendsVZ:

- A telecom company dominating the US market trading at 7.71 P/E and with a fat div-yield. Nice!

I do all this elsewhere, including perpetualEspecially in the current interest rate environment bonds seem to be a no-brainer if you want steady income. You can buy US and EU bonds on IBKR and collect a good coupon with your only worry being the Western World collapsing.

And if you are into BRICS, try to see if you can find USD-denominated BRICS-bonds (or in their own currency if you think the USD is on it's path down but that is up to you).

Yes, it’s in my watch listFor pure dividends there are good options like:

- Altria keeps giving

I don’t like Spain- Enegas is lovely (Spanish gas-company with fat dividends).

I find them risky- Oil refiners in the US used to be my main rec. (like MPC) but they ran up so-hard they are hard to recommend with full conviction.

I don’t like soft drinks

I don’t know enough of it- Newell Holdings is well priced right now imo.

I don’t see a reason to buy it for dividends or else.- IBM pays 4% dividend while being a respectable tech-stock.

Thanks for your analysis!

That does not really matter if the real returns are a lot lower (which they are for that example). But during more bullish times the fund might be a true cash-cow certainly.16% dividends

Maybe it is part of your tax strategy, but you are essentially taking on a lot of risk for a couple % above the risk-free rate (US T-bills, UK Gilts). During a market downturn you will likely suffer draw-downs, while if you own mainly bonds if / when there is some crisis:

1. Your coupon is stable

2. The value of your bonds will go up once QE and monetary easing set-in because rates on newly issued bonds will be lower than the ones you're holding.

I really think that a stable 5/6% yield on the safest instruments in the world are preferable over 8/10% on conjuncture sensitive companies, and funds that charge a 1 to 2% management fee for what is essentially a marketing gimmick (professional funds do not beat the market, nor are they more safe and can contain tail risk that is impossible to quantify).

That fund is essentially a fund of indices. But the expense ratio is negligible so might not be worth the work to acquire them yourself. Sometimes an accumulative ETF can be better if accumulated dividends are not taxed (like in Portugal IIRC) but I generally like that particular Vanguard ETF over the MSCI World one.4,594 holdings?

What do you think of Voo ?That does not really matter if the real returns are a lot lower (which they are for that example). But during more bullish times the fund might be a true cash-cow certainly.

Maybe it is part of your tax strategy, but you are essentially taking on a lot of risk for a couple % above the risk-free rate (US T-bills, UK Gilts). During a market downturn you will likely suffer draw-downs, while if you own mainly bonds if / when there is some crisis:

1. Your coupon is stable

2. The value of your bonds will go up once QE and monetary easing set-in because rates on newly issued bonds will be lower than the ones you're holding.

I really think that a stable 5/6% yield on the safest instruments in the world are preferable over 8/10% on conjuncture sensitive companies, and funds that charge a 1 to 2% management fee for what is essentially a marketing gimmick (professional funds do not beat the market, nor are they more safe and can contain tail risk that is impossible to quantify).

That fund is essentially a fund of indices. But the expense ratio is negligible so might not be worth the work to acquire them yourself. Sometimes an accumulative ETF can be better if accumulated dividends are not taxed (like in Portugal IIRC) but I generally like that particular Vanguard ETF over the MSCI World one.

It is near-identical to the S&P 500 so it's a nice index to own. Not sure what the edge is over SPY though. The US, to me, is still the greatest market to own stocks in, as it is the most capitalistic country on earth with the richest consumers who are brainwashed from birth into consumption, even if it means taking multiple credit lines. The spirit of the American is also very much geared towards the new, which is why novel products and trends spread like an infectious disease across the country. The people of the US carry a magnificent drive and spirit while the country is one of the best places for rich people. It has it all (apart from history).What do you think of Voo ?

I don't live there nor would I ever, I appreciate history and the Old World too much (As expats say: "In America people have dreams, in Europe people have a life"), but in terms of stocks I always buy American. And buying American is a strategy that has never disappointed me in terms of returns, quite the contrary actually. The truth is that the American Empire is the largest on the planet, repatriating immense profits, with the strongest native consumer base on the planet, combined with a concentration of talent that continues to produce world-leading tech, a constellation of vassal states powerful enough to protect its interests everywhere on the planet and a military drilled to the core and zealous in their patriotism, combined with arguably the best military tech on the planet by a wide margin.

The only risk is Donald Trump, but I believe freedom is much too ingrained into the American mind to accept autocratic antics from him if he wants to say overrule elections results. And I believe that, however amoral they are, the capitalist class in the US will in the end eliminate him if he tries to destroy democracy.

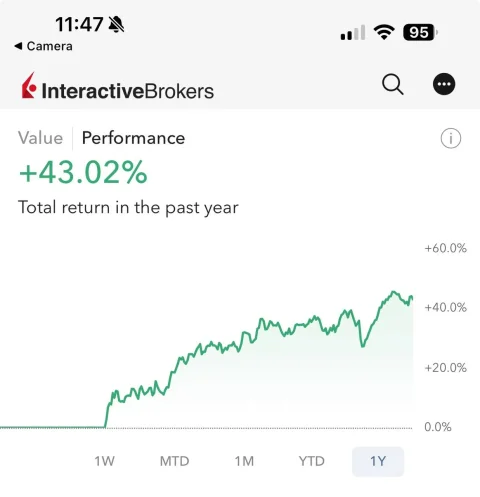

Congrats!I was lucky this year to pick stocks and have a 43% return on my IB.

But as you said "got lucky"

Stock picking is a game of Warren buffett, not of average investors

Check QQQ made 49% this year

The main question with stocks picking or with tech stock like QQQ; would it be possible to generate the same next year?

This is why I like to diversify into all sectors throughout Voo.

QQQ always performing well, and my stocks mostly were from NASDAQ, as you can see I started not in January, probably would get even better returns.Congrats!

But as you said "got lucky"

Stock picking is a game of Warren buffett, not of average investors

Check QQQ made 49% this year

The main question with stocks picking or with tech stock like QQQ; would it be possible to generate the same next year?

This is why I like to diversify into all sectors throughout Voo.

Most of the companies in SP500 are overpriced, I don't know what idiot created a theory with DCA into SP500, that's how you gonna lose and make returns even less than a market.

How do you invest your regular income if not DCA (or value averaging for a slight optimization)?Most of the companies in SP500 are overpriced, I don't know what idiot created a theory with DCA into SP500, that's how you gonna lose and make returns even less than a market.

I'm not sure accumulating waiting for a big enough correction to get a better entry is more effective as "time in the market beats timing the market".

It’s way profitable just to lump sum.How do you invest your regular income if not DCA (or value averaging for a slight optimization)?

I'm not sure accumulating waiting for a big enough correction to get a better entry is more effective as "time in the market beats timing the market".

You said it right, time in the market beats timing the market.

So

Just lump sum and wait, if you make money and get paid once a month, you can buy more stock which fairly valued using valuation models

So you DCA every month.Just lump sum and wait, if you make money and get paid once a month, you can buy more stock which fairly valued using valuation models

The biggest part of my networth is already invested in the stock market, for now I just save the money on savings accounts. once it dips or I will see good opportunities, I will buy more.So you DCA every month.

Dca is about buying every month at the same time and not looking at the prices, normally people automate it.

So you are trying to time the market.The biggest part of my networth is already invested in the stock market, for now I just save the money on savings accounts. once it dips or I will see good opportunities, I will buy more.

- Invest in a globally diversified ETF (around 62% of it is US). Do not FX hedge it (for most people).

- Calculate your stock exposure against your entire net worth (real estate, bonds, gold, crypto, cash etc etc) and find a % that is aligned with your investment horizon and risk tolerance

- US treasuries are attractive this year, maybe it would be wise to park some / most of your cash/bonds into 1 to 5 year bonds @4.5%, and resell on the secondary market when the stock market goes -10% and more to buy stocks on the cheap side.

This is not financial advice.

- Calculate your stock exposure against your entire net worth (real estate, bonds, gold, crypto, cash etc etc) and find a % that is aligned with your investment horizon and risk tolerance

- US treasuries are attractive this year, maybe it would be wise to park some / most of your cash/bonds into 1 to 5 year bonds @4.5%, and resell on the secondary market when the stock market goes -10% and more to buy stocks on the cheap side.

This is not financial advice.

Globally diversified etf Like Acwi historically had been underperforming Voo.- Invest in a globally diversified ETF (around 62% of it is US). Do not FX hedge it (for most people).

- Calculate your stock exposure against your entire net worth (real estate, bonds, gold, crypto, cash etc etc) and find a % that is aligned with your investment horizon and risk tolerance

- US treasuries are attractive this year, maybe it would be wise to park some / most of your cash/bonds into 1 to 5 year bonds @4.5%, and resell on the secondary market when the stock market goes -10% and more to buy stocks on the cheap side.

This is not financial advice.

Also it is 60% USA so if USA economy falls, Acwi will fall as well.

The whole word is tied to one country: USA. If USA collapse, it would be end of humanity.

I get it that you are trying to diversify into global market but in this way you deprive your self from more profits.

I agree with strategy of diversification of assets, some in etf , some in crypto, own home. Own business.

You literally said at first you don't do Dca. But now you say dca every month. Well that is the definition of dca, you don't buy 10$ worth of stocks daily, you buy it once a month. Like most of people are able to save 500$ a month and invest it using dca strategy. It is best. You simply don't know the future. If we compare portfolio of someone who has been investing using dca strategy and someone who was timing the market; result would be dca the winner.It’s way profitable just to lump sum.

You said it right, time in the market beats timing the market.

So

Just lump sum and wait, if you make money and get paid once a month, you can buy more stock which fairly valued using valuation models

I remember i read about this private bank that was looking into its most profitable clients, and they were shocked: Dead people!!!!

The dead did not time the market, did not wait for price to fall, the dead held their investment and kept re-investing.

Dead mode strategy!

Last edited:

USA will die slowly and gradually like the Great British Empire and all the other empires before it. Acwi will adapt to the new reality, as an index is a dynamic environment.Also it is 60% USA so if USA economy falls, Acwi will fall as well.

The whole word is tied to one country: USA. If USA collapse, it would be end of humanity.

Hollywood did a great job.

Past performance is not an indicator of future performance. Also, I am comfortable holding the whole world and my investments will automatically adapt to the changing realities including US getting less relevant over time. I will never replace diversification over the possibility of a higher profit with much less diversification.Globally diversified etf Like Acwi historically had been underperforming Voo.

Also it is 60% USA so if USA economy falls, Acwi will fall as well.

The whole word is tied to one country: USA. If USA collapse, it would be end of humanity.

I get it that you are trying to diversify into global market but in this way you deprive your self from more profits.

I agree with strategy of diversification of assets, some in etf , some in crypto, own home. Own business.

You literally said at first you don't do Dca. But now you say dca every month. Well that is the definition of dca, you don't buy 10$ worth of stocks daily, you buy it once a month. Like most of people are able to save 500$ a month and invest it using dca strategy. It is best. You simply don't know the future. If we compare portfolio of someone who has been investing using dca strategy and someone who was timing the market; result would be dca the winner.

I remember i read about this private bank that was looking into its most profitable clients, and they were shocked: Dead people!!!!

The dead did not time the market, did not wait for price to fall, the dead held their investment and kept re-investing.

Dead mode strategy!

I agree that going all USA is hard to resist based on its performance in the past 20 years but I am into buying the whole world financial market based on the respective countries weights.

That could be but by then IMO we'll all be dead and buried/burnt long before that happens.USA will die slowly and gradually like the Great British Empire and all the other empires before it. Acwi will adapt to the new reality, as an index is a dynamic environment.

However as an immortal wannabe your observation makes sense.

- Status

- Not open for further replies.

Similar threads

- Replies

- 12

- Views

- 1,323

- Replies

- 13

- Views

- 1,852

- Replies

- 5

- Views

- 694

- Replies

- 45

- Views

- 1,024

Latest Threads

-

-

UK Business Advice to Pay Less Tax Elsewhere (It's Time!)

- Started by mhmhmah

- Replies: 7

-

SEPA EMI recommendation that will work comfortably with 6 digits.

- Started by Schopenhauer

- Replies: 6

-

UAE golden visa for staking 100k ton + 35k commission

- Started by pjat555

- Replies: 4

-

English speaking cities with Low taxes?

- Started by Gfjvchnvhb

- Replies: 6