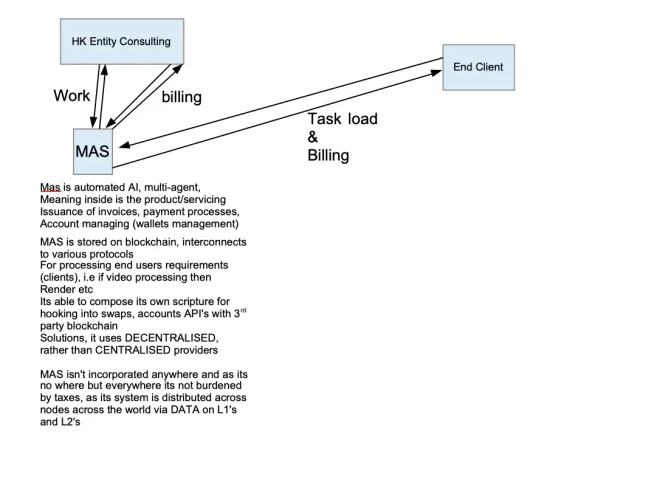

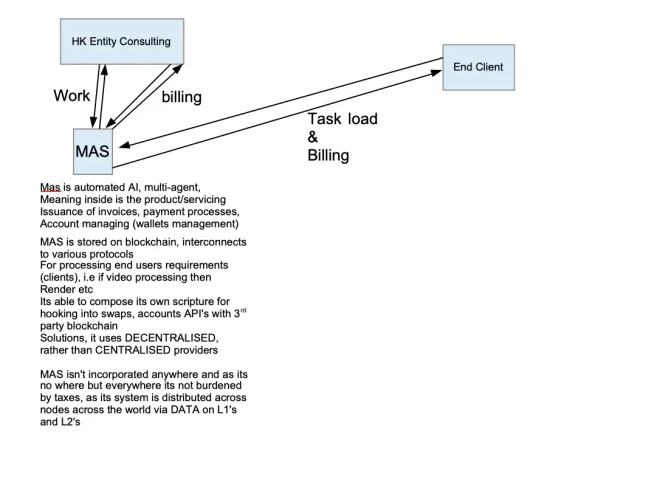

I actually built a system like this previously (so it can be done) the entire front-end, back-end operates on rails the MAS system operates like a entity / human / corporation -> if your business is completely or nearly completely automated and not functioning in centralised applications (say Amazon) i.e front end user interactions isn't operating on a store front etc on a 3rd party centralised service, and your product/service is digital.

You can essentially create a AI system that packages the entire product/service within (and hook into 3rd party solutions operating on-chain) and then have the corporate side work from within the MAS basically taking all HUMAN and ALL CORPORATE elements PLUS ALL DIGITAL SERVICING into a AI multi-agent system -> from there it's basically everywhere but nowhere, its operations occur on-chain and are enacted by a node the other-side of the world, millions of nodes across the globe.

Its able to pay, collect, invoice etc and manage its reserves as they build up.

Basically the AI becomes a corporation, you on the other hand just bill the 'corporation' for contract work, either directly or indirectly via a corporation (say HK).

The Gov can only hold you accountable for '

tax evasion' if you operate the MAS (have control over it) they can't if its legitimately decentralised and operationally self sufficient.

You are therefore a employee/contractor that negotiates/bills the AI

the end clients deal with the AI much like people deal with Digital companies today.

Likewise you can withdraw (rug your ai) when you are sufficiently non-taxed exposed (jurisdiction) by 'negotiating' its retirement.

hat most likely they won't accept the offshore claim as he has not paying taxes where the company is managed from. And then it is still illegal but with a 8000 USD overhead.

Not sure i follow

Quite a stupid way to try to be smart.

He's using a dormant company for

-

KYC/KYB

- Payments (

crypto) paid on behalf of?

- Not doing Accounting?

- Telling the Gov its dormant?

He's fucked.

I actually built a system like this previously

I've since built a much larger system that operates as a MAS but has a team operating it (as i had a heart attack and opted to step away).

Basically almost any digital company can be moved into a MAS based system (means letting go of the company/tech) but it makes it tax exempt - in theory (as operations) as its not operational anywhere and operates within the lines via world wide nodes.