Hello Friends,

I went trough the whole process as a non-resident and I like to share my experience.

My income: 20k per year

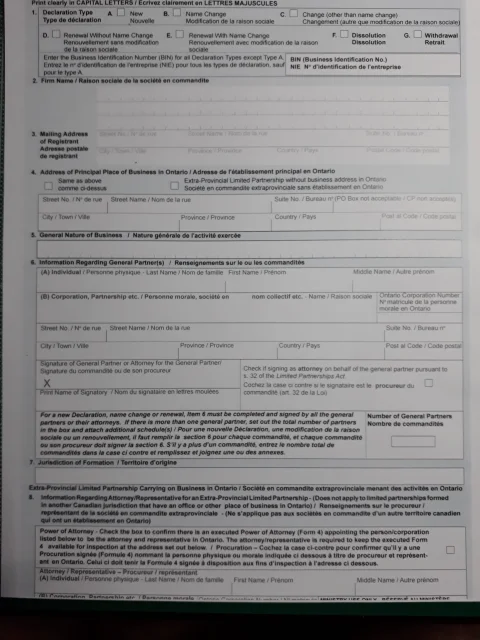

Canada LP: It's a mailbox in ontario, no office or physical presence

Why I chose Canada LP?

Reason1: Write Invoices to my client in Switzerland. Canada has a reputation for high taxes. This way the Tax office in Switzerland will accept the invoices that I produce. This way my client has no problem to deduct his costs.

Reason2: To open up a paypal business account. (big fail). I knew beforehand that I cant open up a bank account in canada. But my consultant told me I can connect the paypal business account with transferwise. He told me he did it over 50 times with clients and it works.

Reason3: To have a legal Business structure. Because I am no resident of any country at the moment (digital nomad).

Costs:

1000$ for consulting. 2000$ for agency that setup the company for me. 1000$ recurring costs to the company after the first year.

How does it work out for me?

To be honest, It was a mistake for my case. I earn only 20k per year. Before you dont make 100k per year, you should not go through the hassle to open up a offshore company.

Good side: Yes I can write the invoices. I talked directly to the accountant of my client and she said its completely legal and accepted.

Downside: No Paypal Business account

I spoke to my high priced consultant and told him "the structure you recommended to me doesnt work". His answer was to use my private paypal account from Switzerland. But this is unprofessional. Clients will see my private name on every transaction. This is bulls**t.

What can I do?

I am looking for a credit card payment processor at the moment. I would also like to open up transferwise. I wish also I had a business bank account somewhere.

Consultant wanted!

If you are a respected member of this forum and think you can help me. I would be happy to pay you.

Merry Christmas

I went trough the whole process as a non-resident and I like to share my experience.

My income: 20k per year

Canada LP: It's a mailbox in ontario, no office or physical presence

Why I chose Canada LP?

Reason1: Write Invoices to my client in Switzerland. Canada has a reputation for high taxes. This way the Tax office in Switzerland will accept the invoices that I produce. This way my client has no problem to deduct his costs.

Reason2: To open up a paypal business account. (big fail). I knew beforehand that I cant open up a bank account in canada. But my consultant told me I can connect the paypal business account with transferwise. He told me he did it over 50 times with clients and it works.

Reason3: To have a legal Business structure. Because I am no resident of any country at the moment (digital nomad).

Costs:

1000$ for consulting. 2000$ for agency that setup the company for me. 1000$ recurring costs to the company after the first year.

How does it work out for me?

To be honest, It was a mistake for my case. I earn only 20k per year. Before you dont make 100k per year, you should not go through the hassle to open up a offshore company.

Good side: Yes I can write the invoices. I talked directly to the accountant of my client and she said its completely legal and accepted.

Downside: No Paypal Business account

I spoke to my high priced consultant and told him "the structure you recommended to me doesnt work". His answer was to use my private paypal account from Switzerland. But this is unprofessional. Clients will see my private name on every transaction. This is bulls**t.

What can I do?

I am looking for a credit card payment processor at the moment. I would also like to open up transferwise. I wish also I had a business bank account somewhere.

Consultant wanted!

If you are a respected member of this forum and think you can help me. I would be happy to pay you.

Merry Christmas