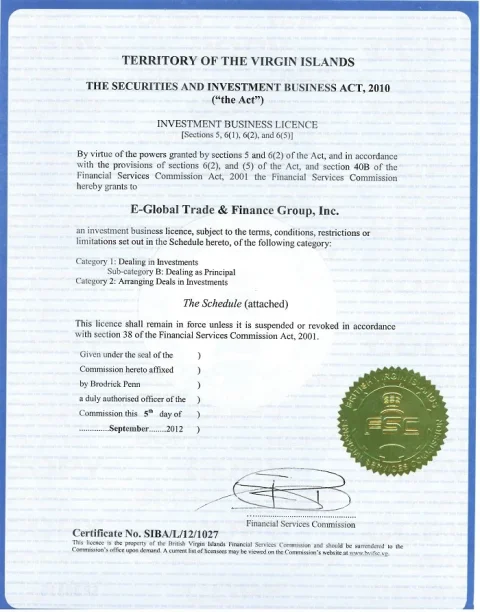

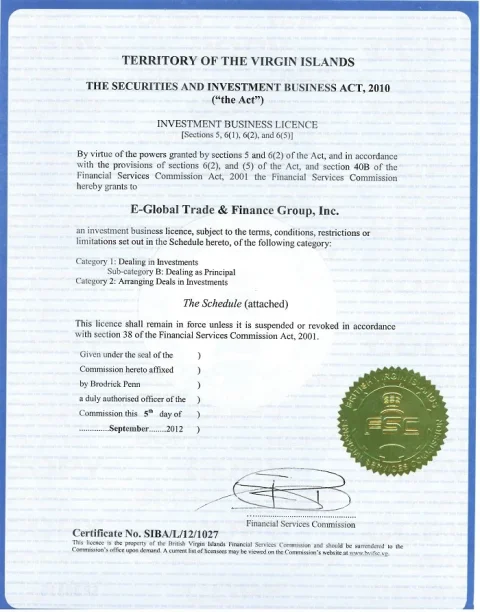

The British Virgin Islands is one of the pioneers in issuing a financial service license to offshore companies.It is one of the first offshore financial jurisdictions in the world and their legislation has become the model for other such jurisdictions. The British Virgin Islands is an island nation that consists of four main islands plus fifty smaller ones, and its official status is a self-governing British Overseas Territory. It is also one of the most prosperous Caribbean economies, and as of 2010 had the nineteenth highest per-capita Gross Domestic Product in the world.The main drivers of the BVIs economy are financial services, which accounts for some 60% of government revenues, and tourism, which makes up virtually the remainder. In addition, it was ranked one of the nine Global Leaders in the March 2015 Global Financial Centre Index issued by the Qatar Financial Centre Authority, where it was upgraded to the status of Transnational Specialist from being a Local Specialist. As a tourist attraction, the BVI is popular as one of the top global destinations for sailing, and one of the top tourist industry earners is yacht chartering.Some of the benefits of applying for a financial service license for your IBC:Unlike some other offshore jurisdictions, as a British Overseas Territory it enjoys a stable political environment, as well as a clean reputation as a reputable offshore jurisdiction which does not deal in money laundering and other questionable activities.Offshore companies incorporated in the BVI do not pay any income taxes or stamp duties on income earned outside of the country.Like other offshore jurisdictions, the BVI has not entered into any international information-sharing agreements. This means that the confidentiality of your company information is preserved. The only corporate documents required to be kept as part of the public record are the Articles and Memorandum of Association.The BVI is a prosperous country which is easily accessible through air and sea transport. In addition, it follows the US Eastern Standard Time, which makes it easier for US-based companies to align their business hours.As a British territory, English is the official language as well as the language of business. In addition, its official currency is the US dollar, which effectively means there are no restrictions on currency movements.IBCs incorporated in the BVI require only one shareholder, director and beneficial owner, who can be the same individual, and may be of any nationality. In addition, the IBC is not required to appoint any operating officials.There is no requirement for the incorporated overseas company to hold Annual General Meetings. In addition, directors and shareholders meetings need not be held in the country and may also be held through electronic means such as telephone conferences. IBCs do not have minimum capitalization requirements, and shares may be issued in a variety of classes, including bearer shares, registered shares, no-par value shares and shares that may or may not come with voting rights.IBCs are allowed to conduct a variety of business activities, including investment and financial management, trading and property holding. However, offshore companies are not allowed to own real estate or conduct trading activities within the country. Other prohibited activities include banking, fund management, insurance and reinsurance, trust management, providing investment advice and collective investment schemes.To acquire a financial service license, you are required to use the services of a licensed registered agent. Documents you need to submit are the Articles and Memorandum of Association as well as a Certificate from your local Registered Agent which certifies that you have complied with the incorporation requirements. You also need to have a registered office address within the BVI, although your primary address may be located outside the country.You must also fill out the application form, which requires you to name a President and Treasurer plus a Secretary (optional) for your company. One person may hold all positions, who may also be the director. Basic details such as passport number, address and country of incorporation or citizenship are required to be provided in the application form. You are also required to provide three proposed company names, which must need with Limited, Incorporated or Corporation, or their abbreviations (Ltd, et al).The basic financial service license fee is US$350 for companies with up to US$50,000 authorized capital and US$1,100 for those with capital exceeding this, and a license renewal fee must be paid annually. In addition, the IBC is subject to other fees as laid out in the schedule of fees under the 2004 BVI Business Companies Act.

/monthly_2015_10/bvi-fx-license-large.jpg.543ea177368427d72b9b8f0420d54e96.jpg

/monthly_2015_10/bvi-fx-license-large.jpg.543ea177368427d72b9b8f0420d54e96.jpg

Last edited by a moderator: